By Ken Donaven, Partner

Willingness to Pay (WTP) research identifies the maximum price a customer is prepared to spend for a product, service, or specific feature before the perceived value no longer justifies the cost in the minds of the intended customer base.

While simple in concept, accurately measuring WTP requires a thoughtful combination of methodology, context, and interpretation. Done well, WTP research equips pricing strategists with data-backed thresholds, incremental value insights, and the means to prioritize features in a way that aligns customer perception with revenue goals.

Over the years, WTP approaches have evolved from broad, product-level tools into more modern, sophisticated simulations that can isolate the value of individual features, quantify competitive implications, and model “real-world” market outcomes.

Traditional Product-Level Approaches

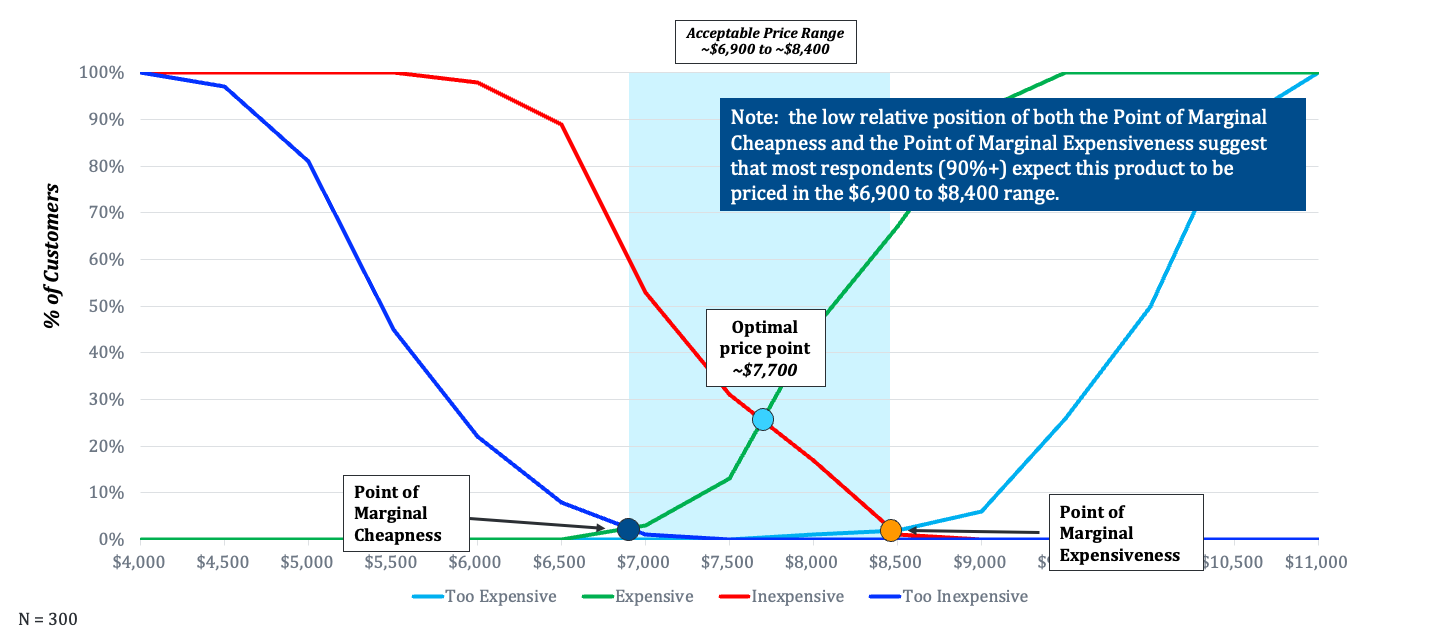

Historically, WTP insights were often embedded in standard price sensitivity studies. A common example is Van Westendorp Price Sensitivity Modeling. In this framework, respondents identify four price points:

- Too inexpensive to be credible

- Inexpensive but acceptable

- Expensive but still a possible purchase

- Too expensive to consider

This yields a traditional price sensitivity chart that identifies the Optimal Price Point and the Range of Acceptable Prices.

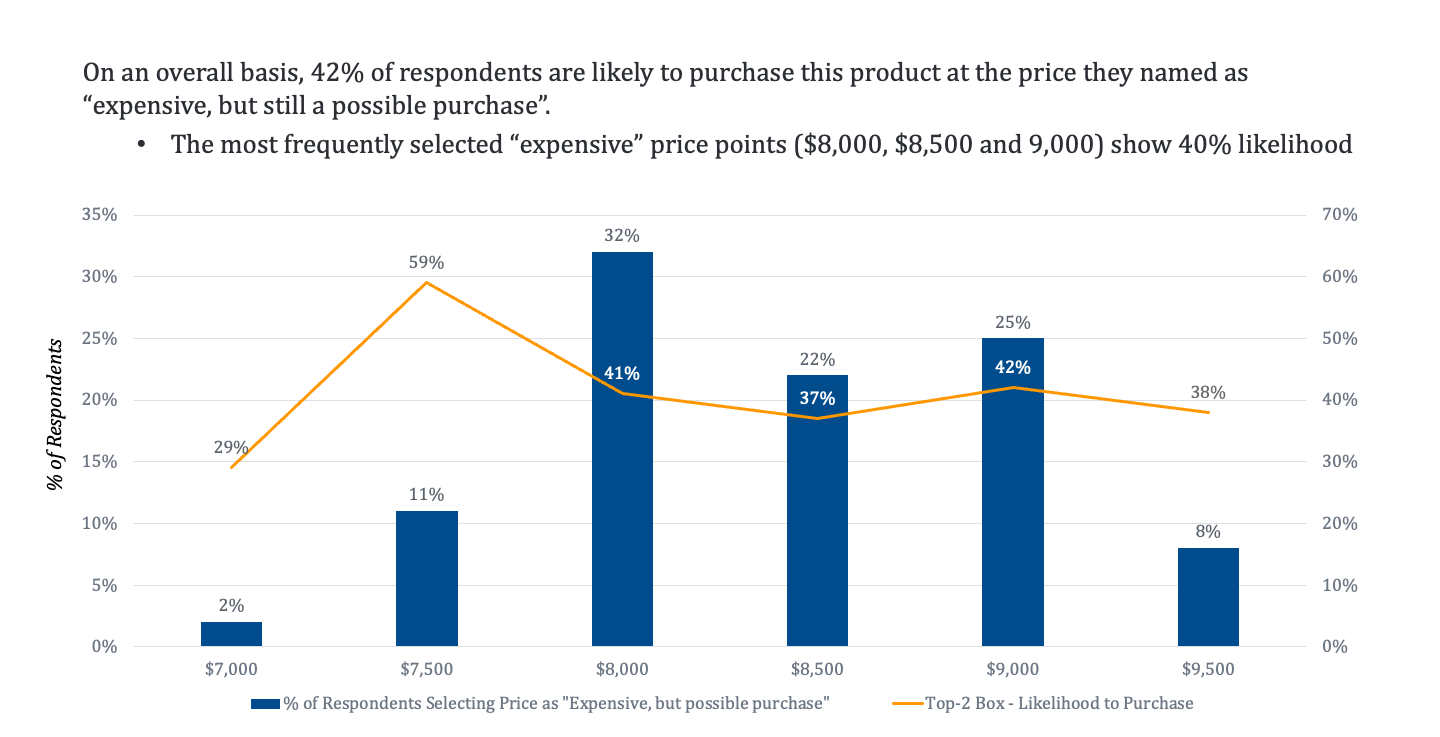

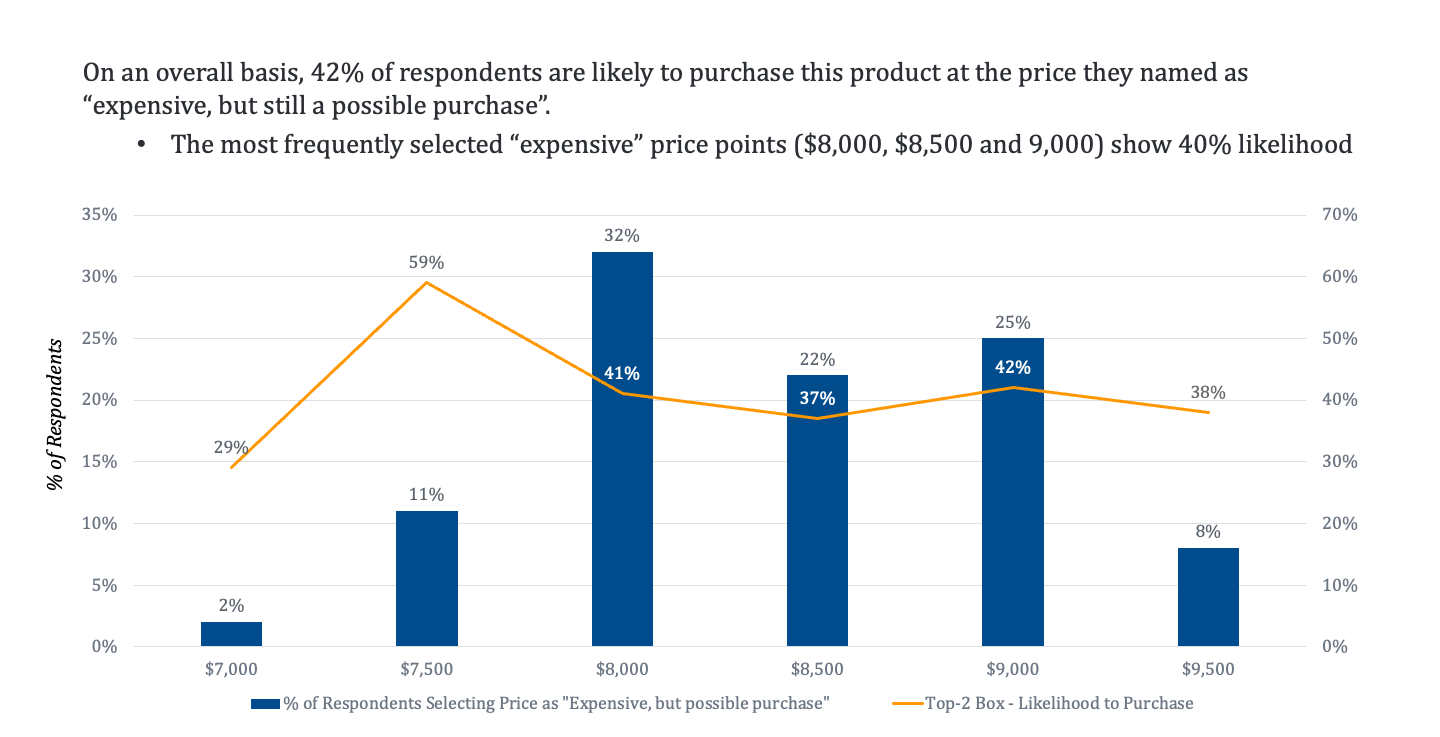

Taking this analysis one step further, we can use the “expensive but still a possible purchase” price point as a rudimentary WTP analysis. By adding a likelihood-to-purchase question at that identified price point, Martec can estimate potential demand and build revenue curves based on real-world customer insights and preferences.

Example:

If $500 is identified as “expensive but still a possible purchase” and 20% of respondents report a high likelihood of buying at that price, revenue and profitability can be modeled accordingly.

This method is particularly useful when the goal is to understand holistic willingness to pay for an entire product. However, it does not isolate the incremental value of specific attributes, as may be the case with proposed product improvements or new feature additions.

Feature-Level WTP: Early Proxies

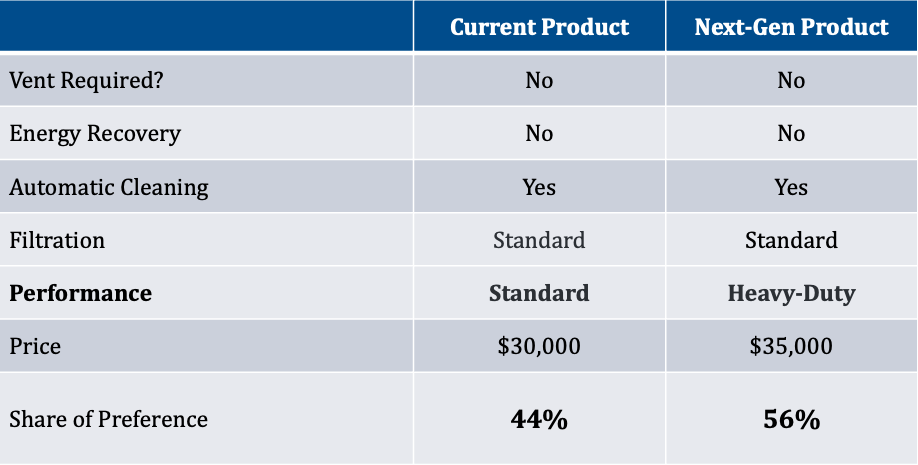

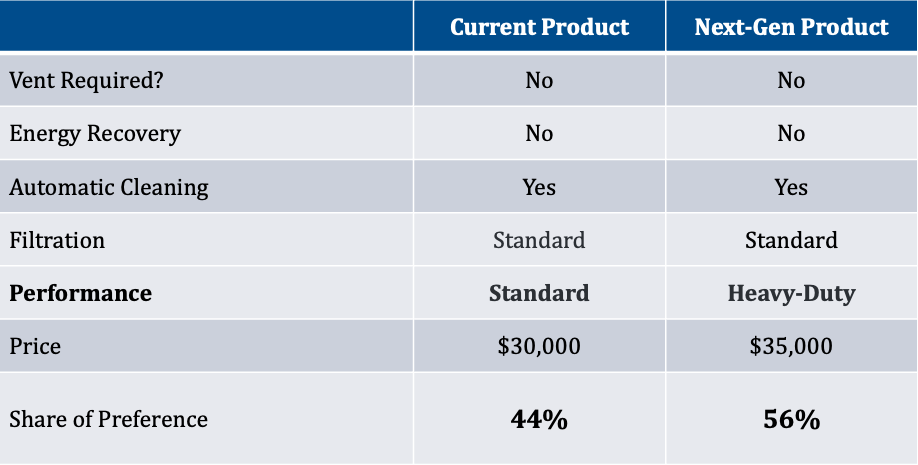

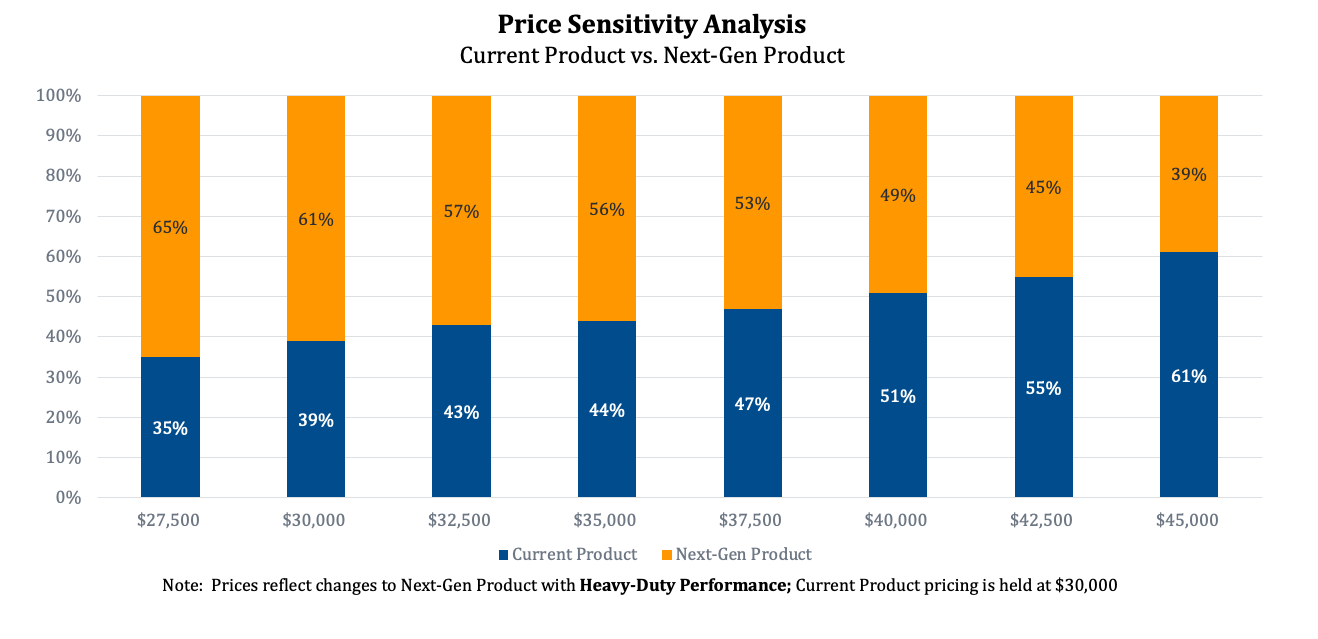

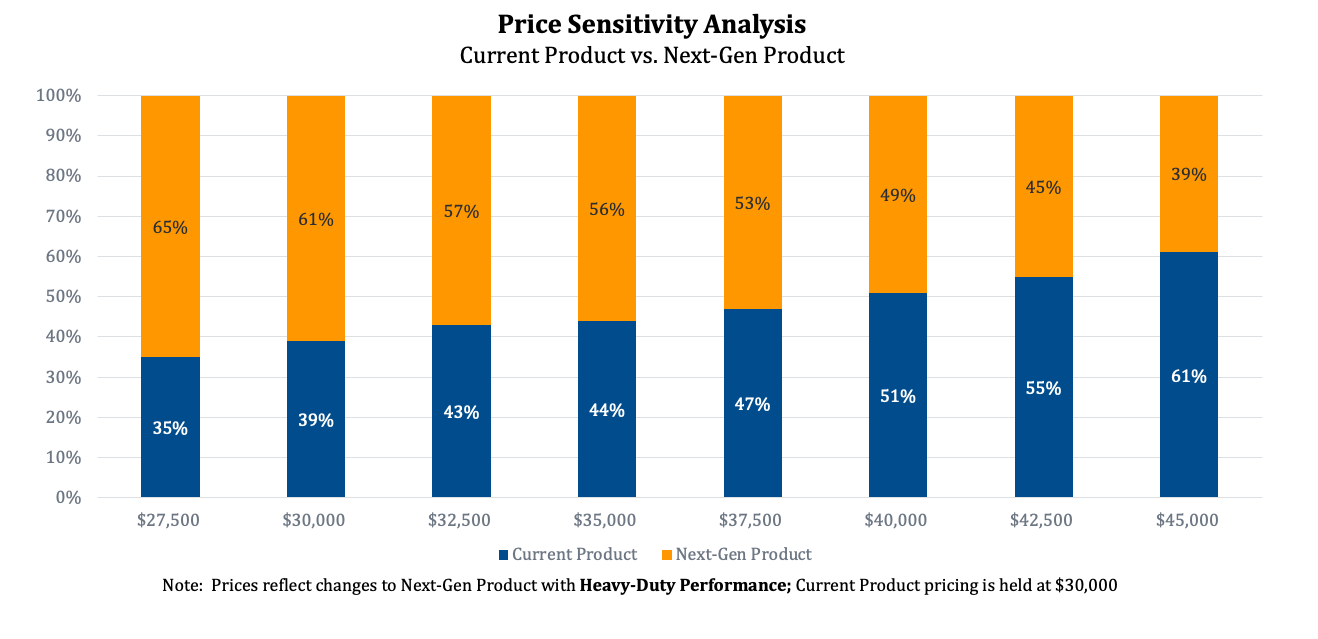

When clients wanted to understand the value of individual enhancements, early-stage approaches often included binary trade-off exercises through the use of choice-based conjoint analysis. In these, simulations can be designed to understand how changing an attribute impacts “share of preference” between two products from the same brand—for example, a current model versus a next-generation version with an additional feature. By capturing the shift in share of preference and linking it to known price differences, researchers could infer what those features were “worth.”

In addition, a price sensitivity analysis can be completed, to understand how share of preference changes between the two products at all price options in the conjoint exercise. This analysis provides further insight into willingness to pay for the next-generation features.

In this instance, the most potential customers are willing to pay for the next-generation feature is between $7,500 and $10,000.

It is important to note that while useful, this approach could potentially overstate willingness to pay, because it does not:

- account for competitive market responses

- include a “none of the above” option for respondents, or

- reflect real-world purchase hesitation that might not be captured without additional qualitative insights

While a useful proxy in its time, this method often yielded insights that are more directional than definitive. However, there is now a better approach to capture willingness to pay insights.

Modern Solutions: Conjoint Analysis with WTP Simulation

Modern conjoint platforms include WTP simulators capable of modeling hundreds of potential purchase scenarios based on raw survey data.

Here’s how it works:

- Respondents complete a choice-based exercise, comparing different combinations of product features and price points.

- The platform’s algorithm analyzes patterns in these choices to determine the relative importance of each feature and the premium customers will pay for each level of that particular product feature.

- By running simulated “what-if” scenarios—changing only one variable at a time—researchers can isolate the incremental value of that specific feature variable.

Example:

A roofing manufacturer offers 20-year, 30-year, and 50-year shingles. Simulation results might reveal that customers are willing to pay $2,000 more to upgrade from a 20-year to a 30-year shingle, but are not likely to spend an additional $5,000 to upgrade all the way to the 50-year shingle. Because the model controls for other external factors and variables, this figure and subsequent analysis is grounded in observed trade-offs, rather than speculation. It also provides a much deeper understanding of where maximum profitability can be specifically identified in developing pricing strategy.

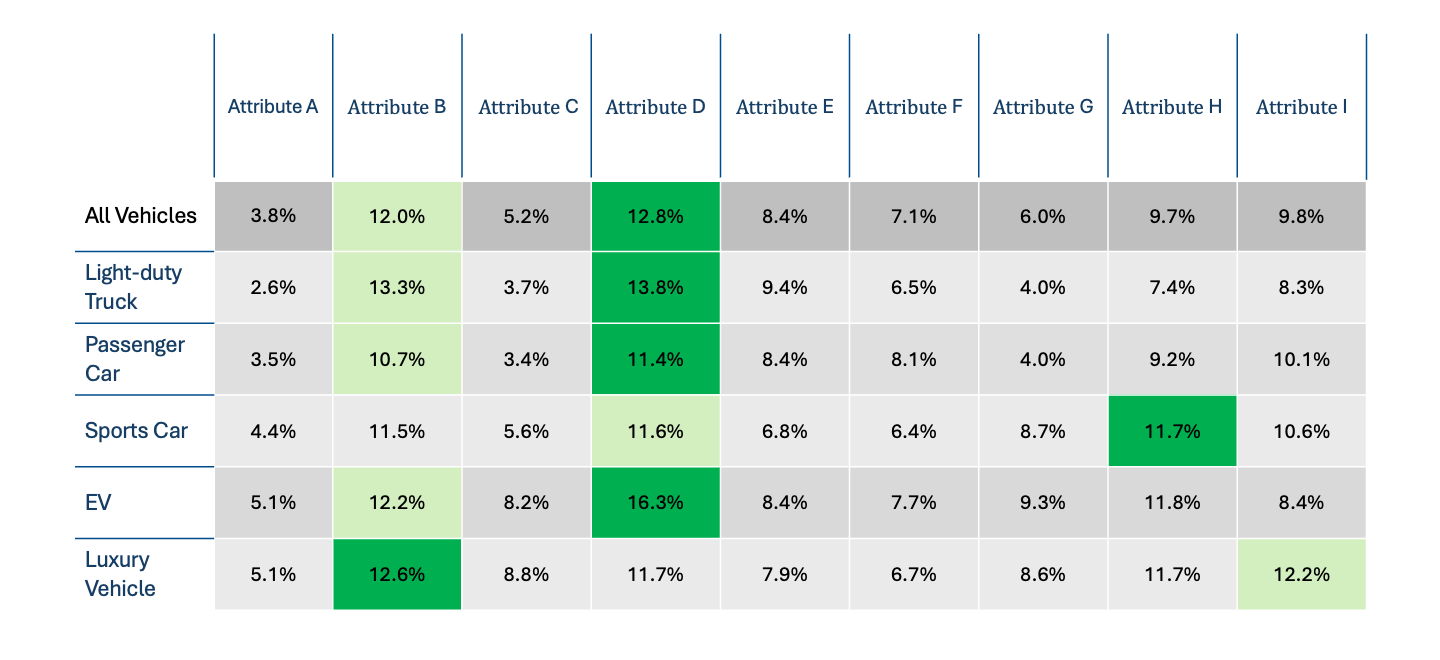

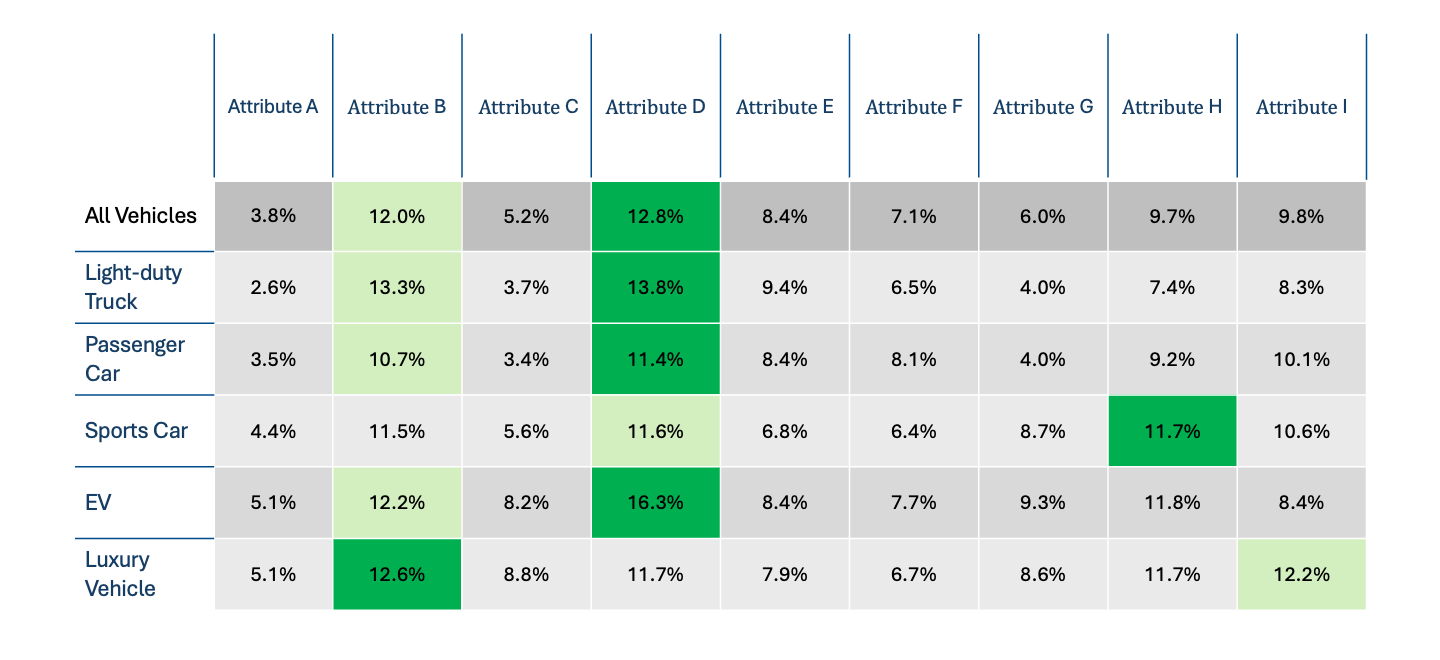

In this example, respondents are clearly willing to pay more for Attributes B and D.

Interpreting WTP Outputs

The value of conjoint-based WTP simulation lies in its ability to:

- quantify the price premium customers will pay for specific features

- predict shifts in market share under different pricing and feature configurations

- test scenarios before launching a product, new product features, or price changes

However, it’s critical to interpret results with the appropriate expectations:

- Willingness to Pay values represent average market response, not guarantees for every customer.

- Market context matters. Competitive moves in response, macroeconomic shifts, and channel dynamics can alter actual results.

- Extremely low or high simulated prices can produce “unbelievable” scenarios, at which point respondents disengage.

Avoiding the “Additive” Fallacy

One of the most common missteps in WTP research is assuming that individual feature premiums can be simply added together. From the example above, respondents are willing to pay ~12.0% more for Attribute B and ~12.8% more for Attribute D.

Such a scenario does not automatically mean customers will pay 24.8% more if a new product includes both attributes. Customer valuation is not linear. Interest in one feature may diminish the perceived value of another, and budget ceilings often cap total spend at some point…perhaps somewhere in between the 12% more they are willing to pay for one attribute and the cumulative premium of 24.8%.

When pricing products with multiple enhancements, it’s important to use a methodology that accounts for cumulative effects, such as Martec’s Benefit-Value Analysis.

When to Use Benefit-Value Analysis (BVA)

If the goal is to measure cumulative Willingness to Pay for a bundle of features or benefits—such as a next-generation product launch—Benefit-Value Analysis is the more appropriate tool. BVA accounts for:

- the percentage of respondents willing to pay for each benefit

- the degree to which multiple benefits influence each other’s value

- a realistic total premium customers will accept

This approach is particularly effective for solutions that are “outside the norm,” where benefits extend beyond the product itself (e.g., reduced installation time, eliminated redundant or thereby obsoleted equipment, etc.). When understanding willingness to pay with such added complexity, BVA is often the preferred solution. In fact, we were even to conduct BVA studies when the client wished to not specifically name or describe the proposed solution at all to respondents!

Choosing the Right WTP Approach

| Objective | Recommended Method |

| Understand overall product-level WTP | Van Westendorp + likelihood-to-purchase questions |

| Isolate WTP for individual features | Conjoint analysis with WTP simulation |

| Determine cumulative WTP for multiple new features | Benefit-Value Analysis |

Selecting the right tool—or combination of tools—ensures that Willingness to Pay insights are both accurate and actionable.

Applying WTP Insights to Business Strategy

When done correctly, WTP research provides:

- clear thresholds for acceptable price points

- quantified value of specific product enhancements

- data-driven guidance for feature prioritization and bundling

- a foundation for both marketing and product development strategies

By combining traditional product-level assessments with advanced conjoint simulations and cumulative-effect modeling, organizations can precisely align pricing with customer value perception, maximizing revenue potential while maintaining market competitiveness.

Ken Donaven is a Partner with The Martec Group. He can be reached at [email protected]. If you would like to explore Willingness to Pay or any of Martec’s advanced pricing research methodologies, please don’t hesitate to reach out.