By Josh Emington and Rick Claar

Commercial Due Diligence (CDD) isn’t just a box to check in the private equity dealflow process—it’s one of the most decisive steps in shaping conviction around a deal. While it can take many forms depending on the target, market and thesis (as explained and explored in detail here), traditional CDD projects typically share a common structure, purpose and cadence.

This article outlines what’s inside the envelope of a standard CDD engagement, when it happens, and how we structure our work at Martec around five core pillars. Our next installment will dive more deeply into a number of the additional modules investors may wish to explore for a more fulsome and customized Commercial Due Diligence effort.

Where CDD Fits in the Deal Timeline

It is important to emphasize that CDD doesn’t happen in isolation—it’s one of several concurrent diligence streams unfolding between the expression of interest (IOI), letter of intent (LOI), and close. While the core CDD sprint typically begins post-LOI and runs for three to four weeks, timing varies. In some competitive situations, we’re invited to contribute earlier, signaling the investor’s seriousness with a memo or even pre-diligence support before exclusivity is granted.

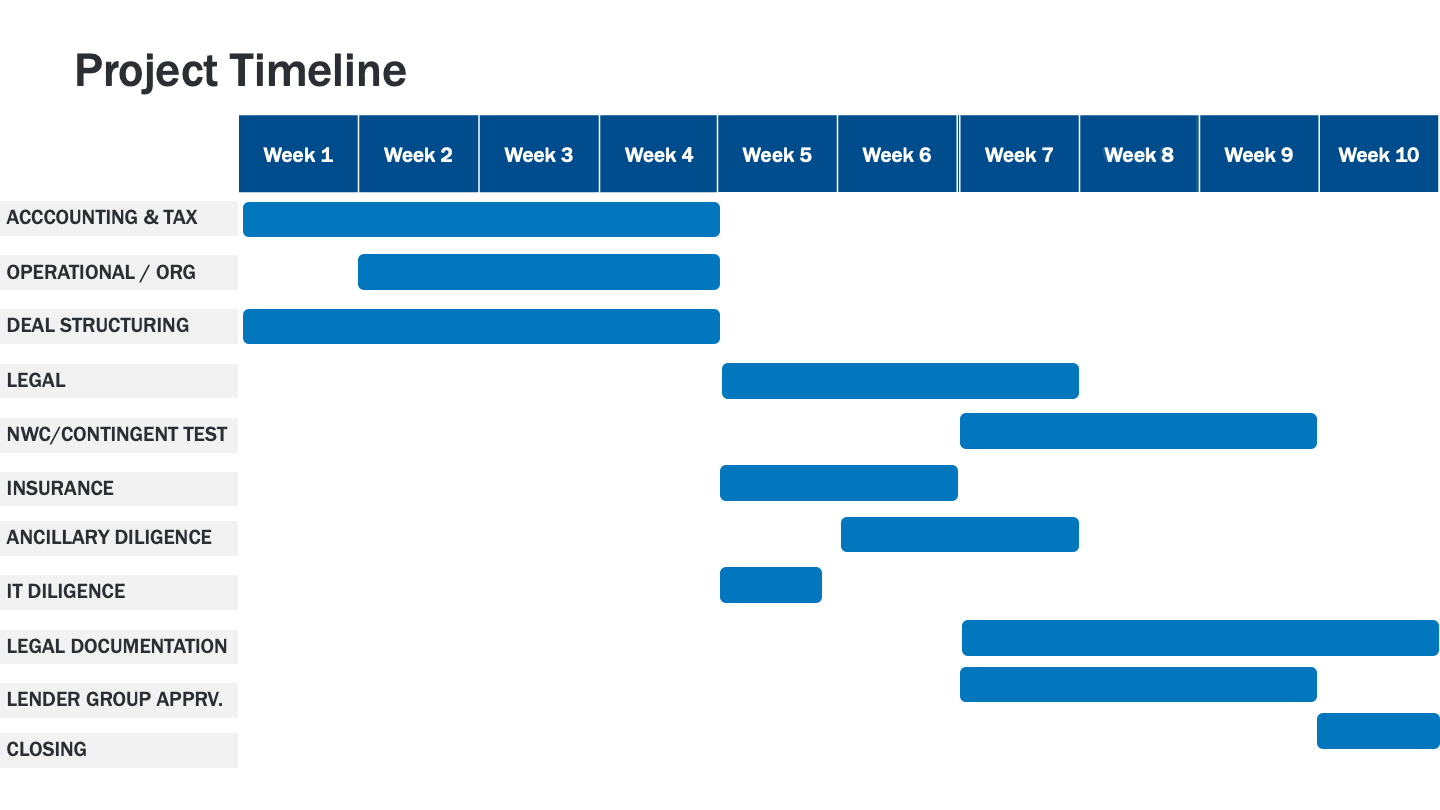

We like to help clients visualize this timing with a Gantt-style timeline, showing how CDD fits in alongside accounting diligence (including QofE), legal review, ESG diligence, and other ancillary streams. Mapping the phases this way helps all parties stay aligned on who’s doing what—and when.

Here is a representation of an auction format deal flow and timeline:

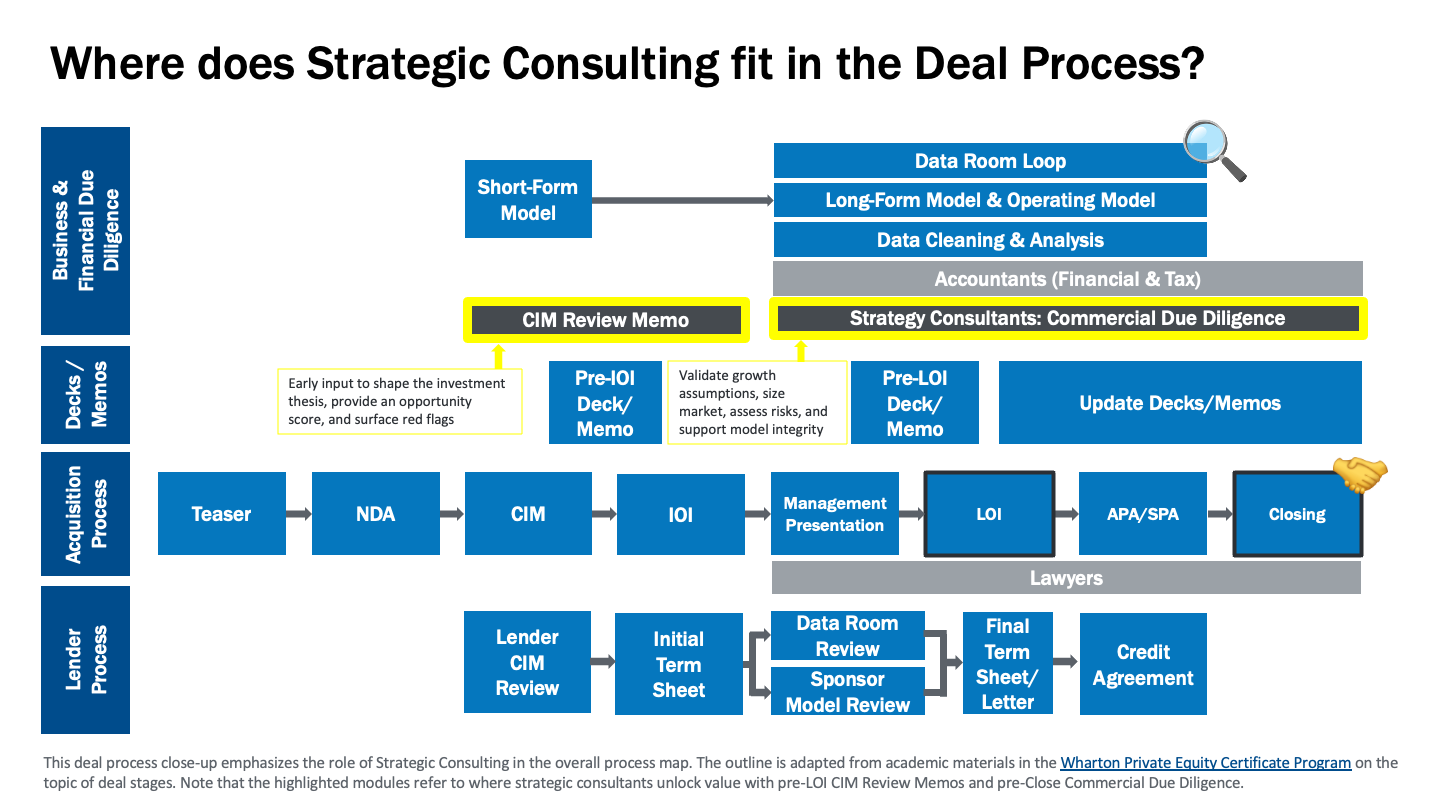

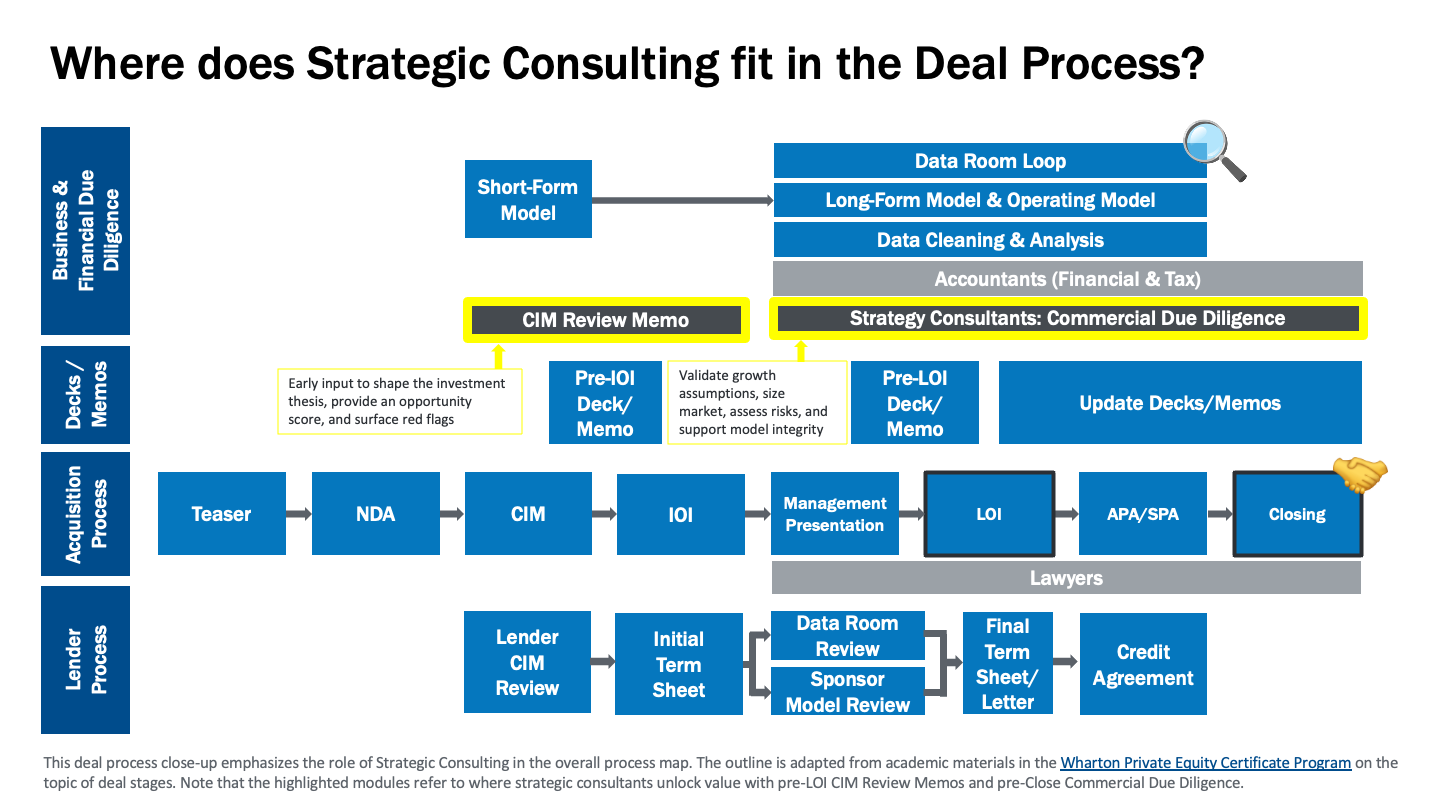

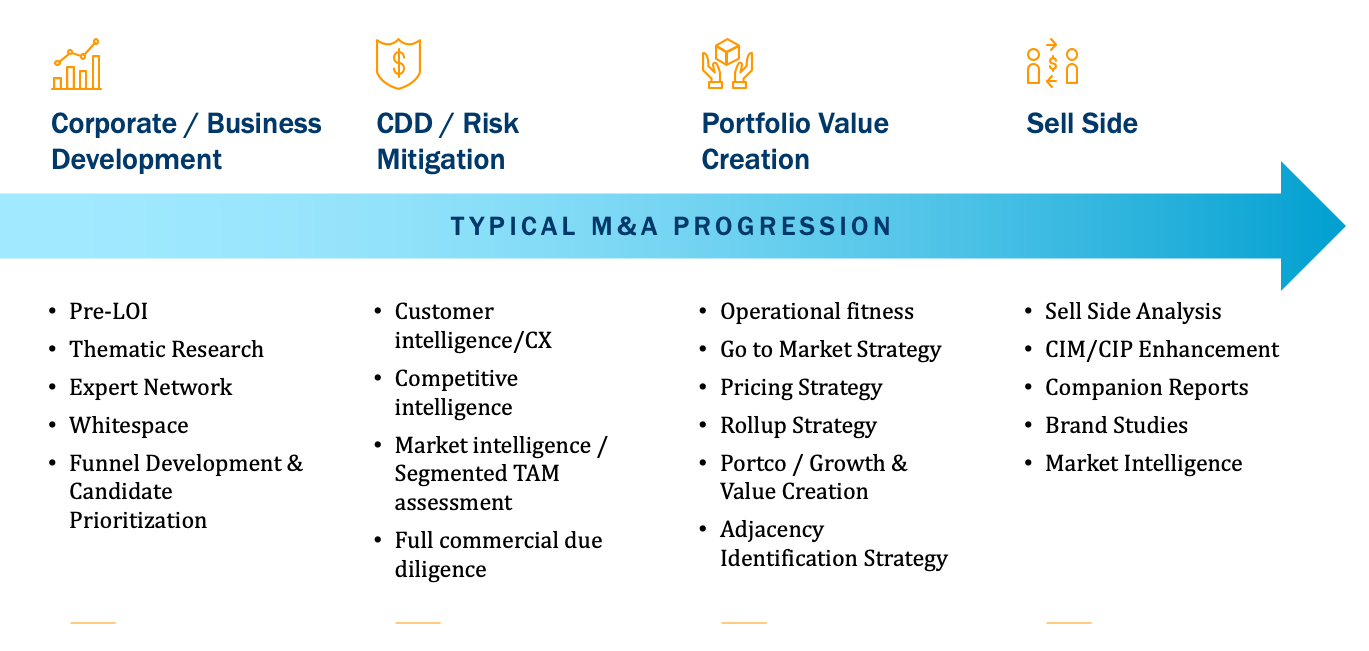

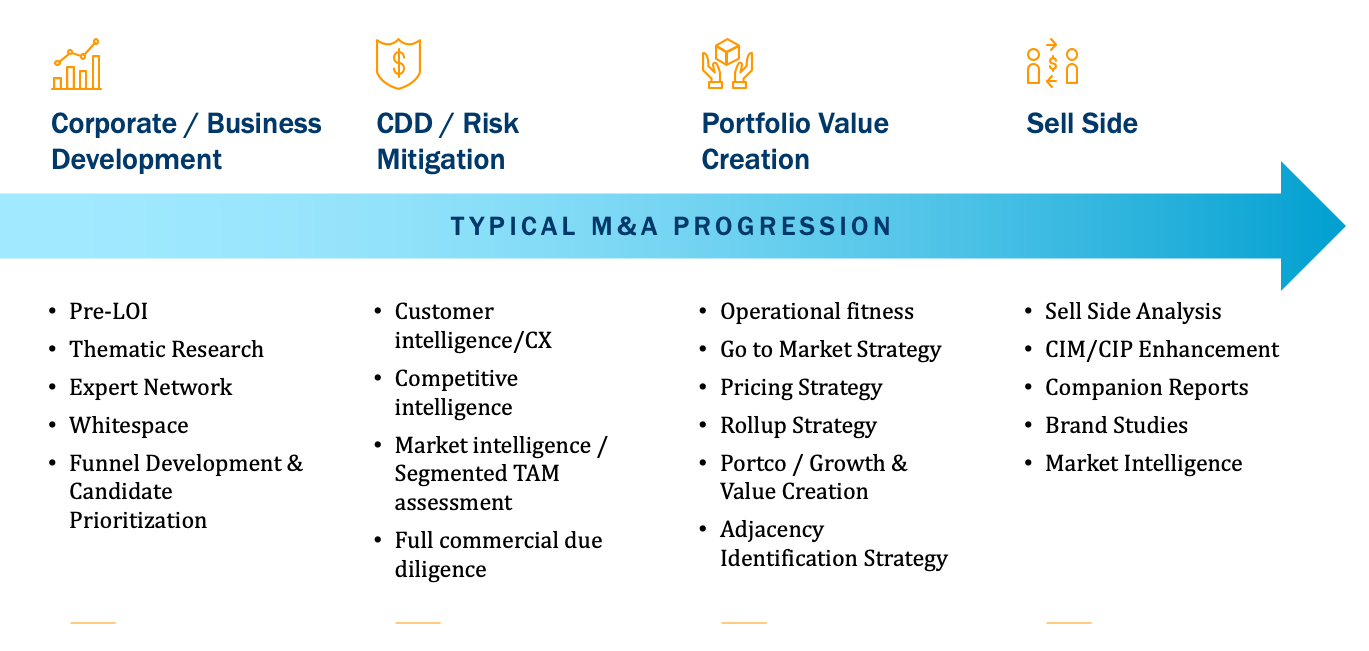

You can see how this timeline fits into a larger time horizon with other strategic consulting and market research services for investors, for example:

Early Engagement: The Memo Phase

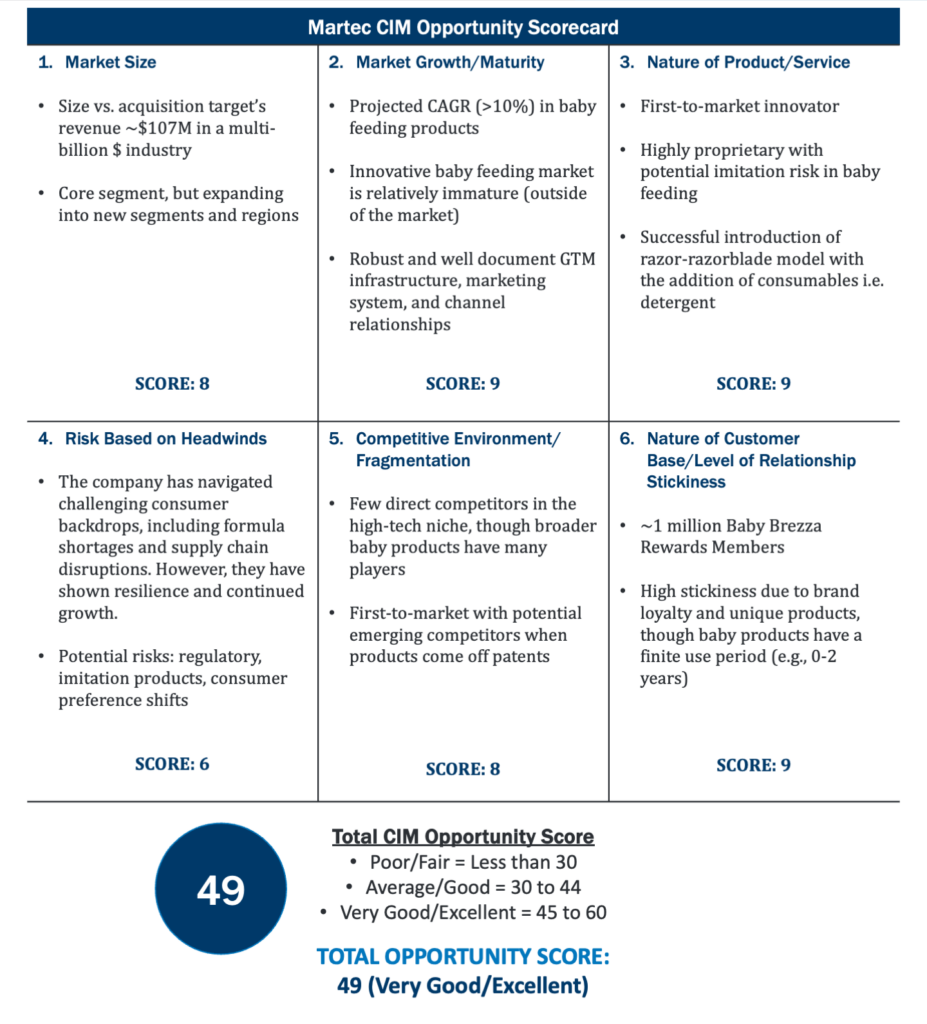

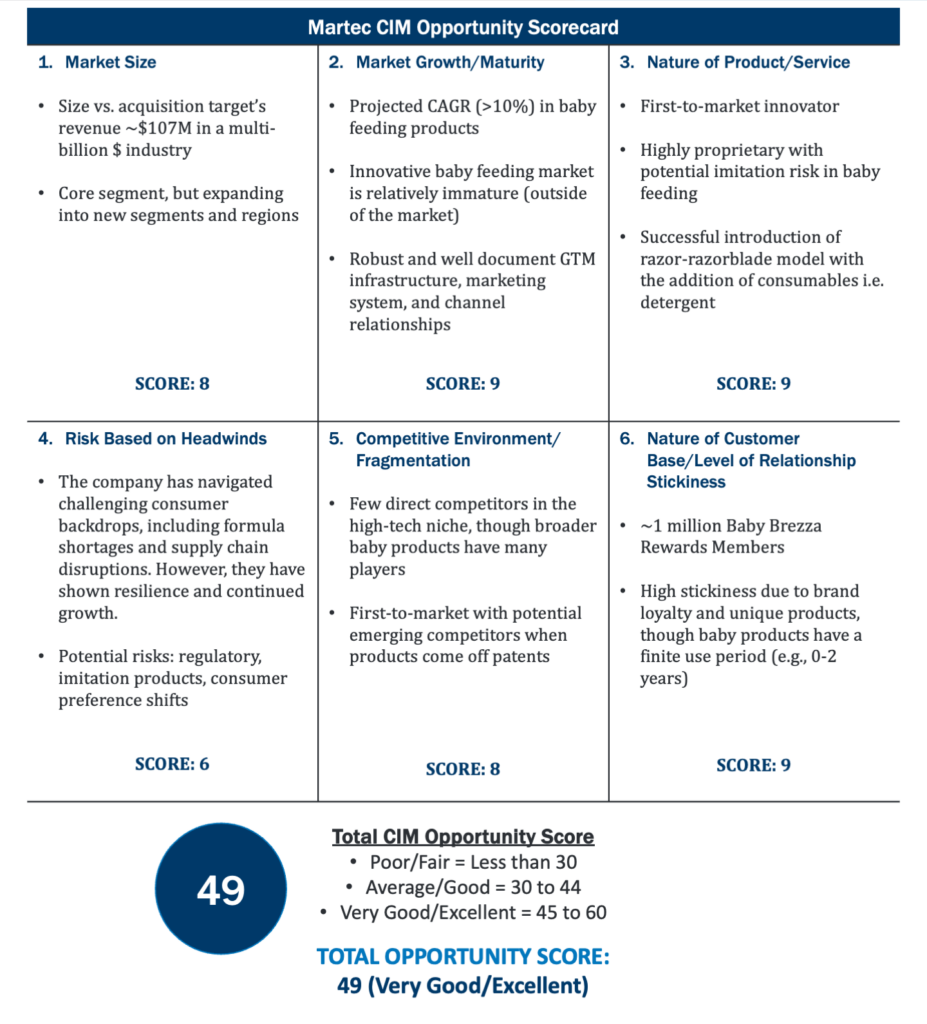

Before kicking off full diligence, many investors want to sharpen their thesis. That’s where a strategic memo comes in. At Martec, we offer a complimentary early-stage memo that reviews available seller materials—like a confidential information memorandum (CIM) or management presentation—and highlights key market signals, potential risks and initial thoughts on attractiveness.

Even when deal materials are sparse, we can build an early picture from internal questions or hypotheses the investor has.

We’ve indexed a large number of CIMs, so we can often benchmark a given opportunity against prior deals and provide a preliminary Martec Opportunity Score (MOS)—our quick-read framework for understanding where a deal might sit in terms of risk and upside.

The benefit of this early memo isn’t just the insight—it also helps us align with the deal team early and hit the ground running when diligence formally begins.

Post-LOI: The Core Questions of Commercial Due Diligence

Once the project moves into a formal CDD engagement, the objective is simple: generate clarity and confidence. That means answering a set of critical questions that help investors decide not just whether to do the deal, but how to underwrite growth.

Here are some of the most common and valuable questions we tackle:

- What is the true size and growth trajectory of the target market?

Understanding the current market size and projected growth helps assess the sustainability and scalability of the business. - Who are the key competitors, and how does the target differentiate itself?

Identifying the competitive landscape and unique value proposition of the target company ensures the deal team can anticipate market pressures and competitive dynamics. - What is the quality and stability of the customer base?

Evaluating customer concentration, retention rates, and satisfaction levels helps assess revenue stability and potential churn risks. - Where are the levers for revenue and margin expansion?

Understanding whether growth will come from price increases, new product launches, geographic expansion, or operational efficiencies is critical for post-acquisition strategy. - How resilient is the business model across cycles?

Assessing the target’s adaptability and financial health during different market cycles can inform risk mitigation strategies. - What are the operational risks and execution challenges post-close?

Identifying integration challenges, supply chain vulnerabilities, and key dependencies helps in planning for smoother post-close operations. - How effective is the go-to-market (GTM) strategy?

Reviewing the effectiveness of marketing, sales channels, and partnerships reveals how well positioned the target is to capture future opportunities. - Is the management team equipped to lead the next chapter?

Ensuring that leadership has the skill set, experience and strategic vision to execute growth plans is essential for maintaining value. - What regulatory, legal or compliance hurdles exist?

Identifying potential legal, environmental, and industry-specific regulations ensures the deal team is prepared for compliance-related costs or delays. - How do technological or macro trends impact the thesis?

Evaluating how future innovations could disrupt or enhance the target’s business model helps shape long-term strategy. - Do the financials align with industry benchmarks?

Verifying financial accuracy and comparing key metrics with industry standards aids in confirming valuation assumptions and growth expectations. - What synergies or strategic fit can be realized?

Understanding how the target fits with existing portfolio companies or strategic plans can enhance the overall investment thesis and value creation strategy.

The Five Pillars of Commercial Due Diligence

Each of the above enumerated questions and the answers they drive towards map to a specific category of analysis. Specifically, we organize our work around five key diligence pillars to address them holistically as part of a traditional CDD engagement. (Future installments will dive more deeply into each of these, but for our purposes here, this is a high-level view of these pillars.)

1. Market Intelligence

The most important risk in any deal is often the market itself. A rising tide can lift all boats—or swamp them. Such Market Intelligence work typically includes, among more:

- Sizing and forecasting: Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM)

- End-markets and customer segmentation

- Industry trends and market dynamics

- Growth and contraction forces within the category

- Demand drivers and seasonality that might exist or fluctuate

As one investor put it, “We want to know if this company can ride the wave.” That means understanding the market’s shape and direction—both now and into the future.

2. Competitive Intelligence

It is important that investors understand where the target fits in the landscape, how it competes, and how defensible its position really is. To that end, traditional CDD engagements should include:

- Competitor profiling and positioning

- Market mapping by product, geography, channel and audience

- “Five Forces” analysis: competition, the threat of new entrants to the market, supplier bargaining power, customer bargaining power, and the ability of customers to find product substitutes.

- Benchmarking (e.g., go-to-market strategy, target headcount, adopted technology stack, equipment, plant size and placement, vendor stack, e.g.) — what works, and what doesn’t?

3. Customer Intelligence & ICP Research

Customers are the ultimate validators. We dig deep into voice-of-the-customer (VoC) feedback to assess satisfaction, loyalty, and potential red flags among the target’s ideal customer profile (ICP), such as:

- Contract security and growth outlook

- Selection and purchase criteria

- CSAT scoring (NPS, MES, CES)

- Ideal customer profile definitions and drivers

- Customer journey mapping

- Language and framing customers use to describe the target and competitors

4. Growth Assessment

We analyze both the company’s stated growth plans and the investor’s hypothesized growth opportunities, testing feasibility and value creation potential:

- Market sizing for new segments, geographies, and products

- Entry-point validation through concept testing studies

- Customer appetite for cross-sell/upsell

- Benchmarking similar strategic moves

We want to understand not just if there’s upside, but how to capture it—and whether “the view is worth the climb.”

5. Target Attractiveness

This final pillar brings together operational, pricing, and strategic fit elements, leveraging methodologies such as:

- Pricing analysis

- Product/service assessment

- Supply chain and vendor relationships

- Process and equipment benchmarking

- GTM structure and tools

- Online reviews and brand sentiment

We also evaluate the strength of the management team and its alignment with investor goals.

Exploring More Than Meets the Eye

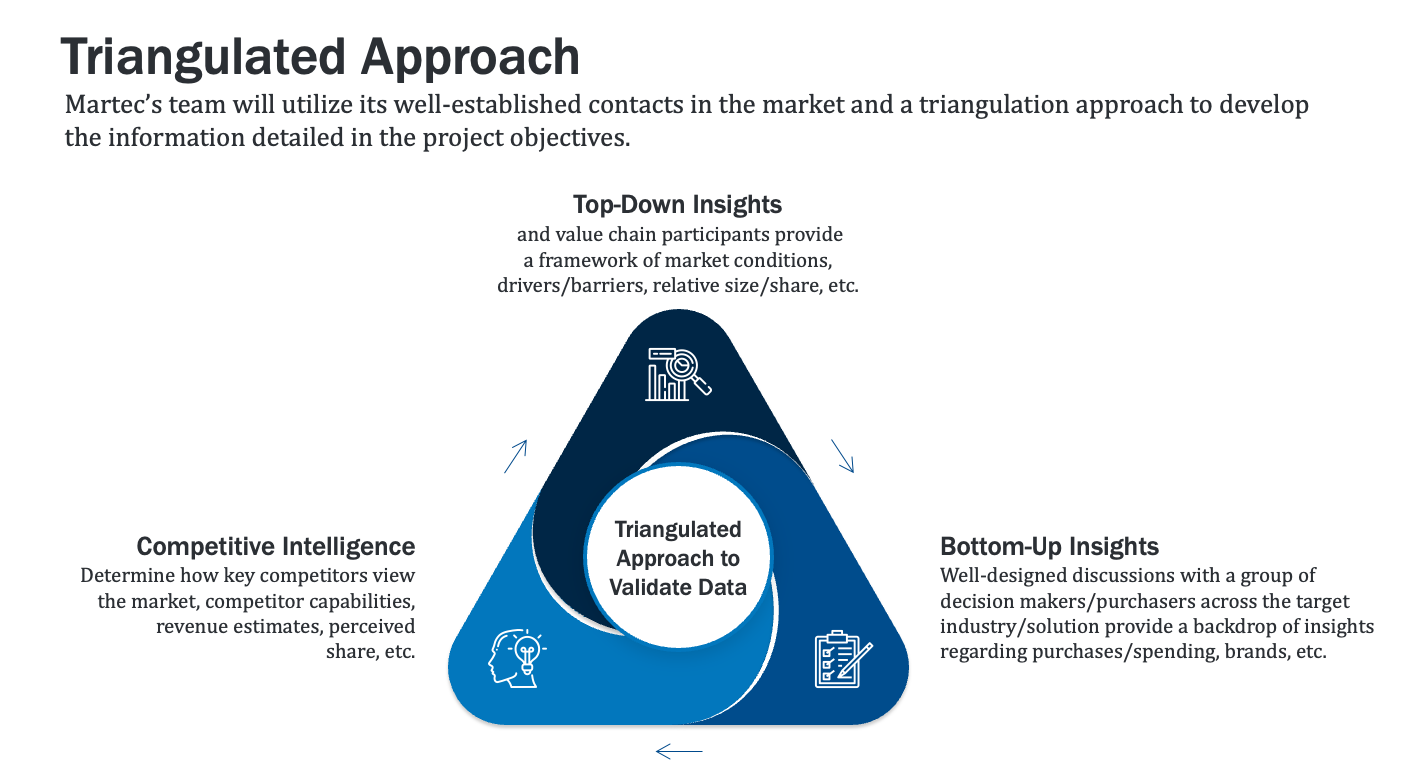

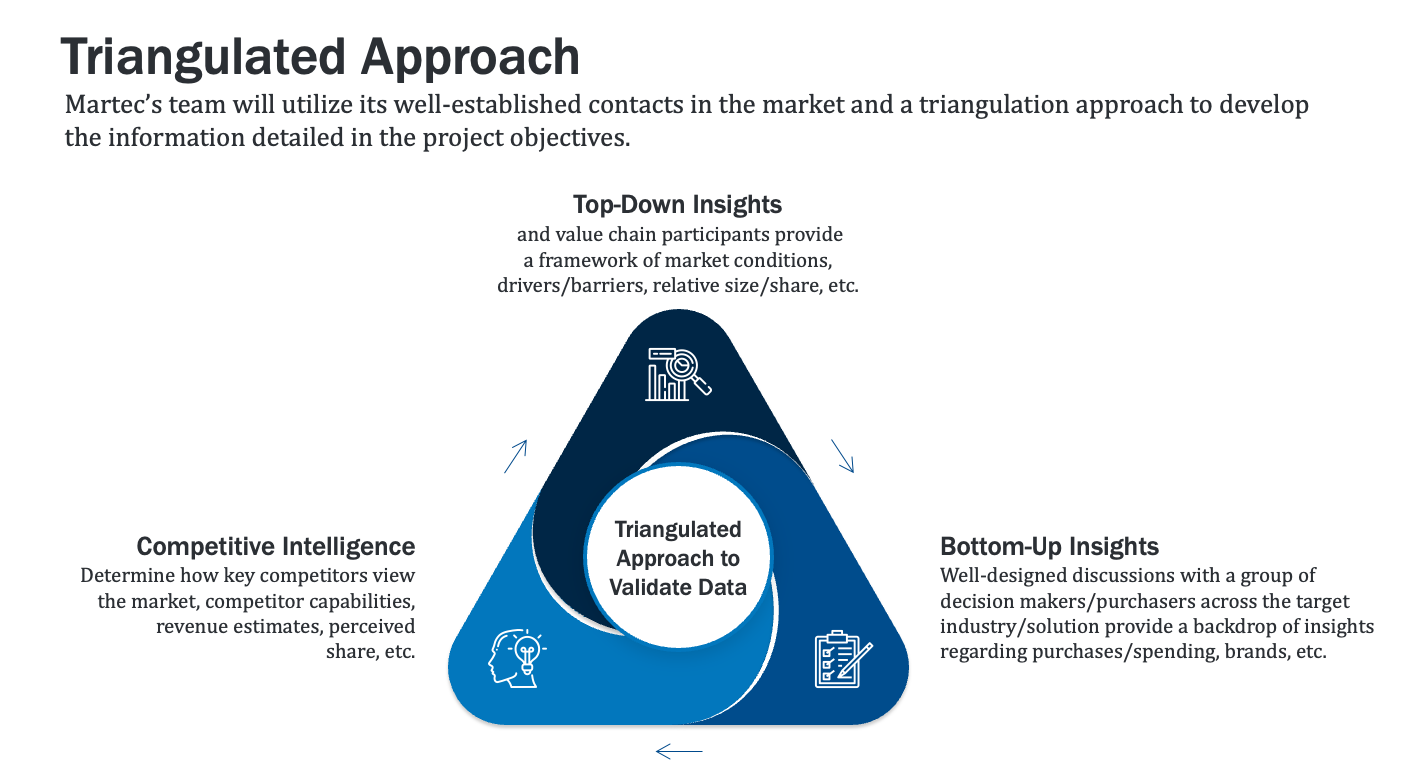

There are two critical overarching approaches that make or break such analyses:

- One is what we call “taking a triangulated approach,” and the other is

- Walking the walk to talk the talk.

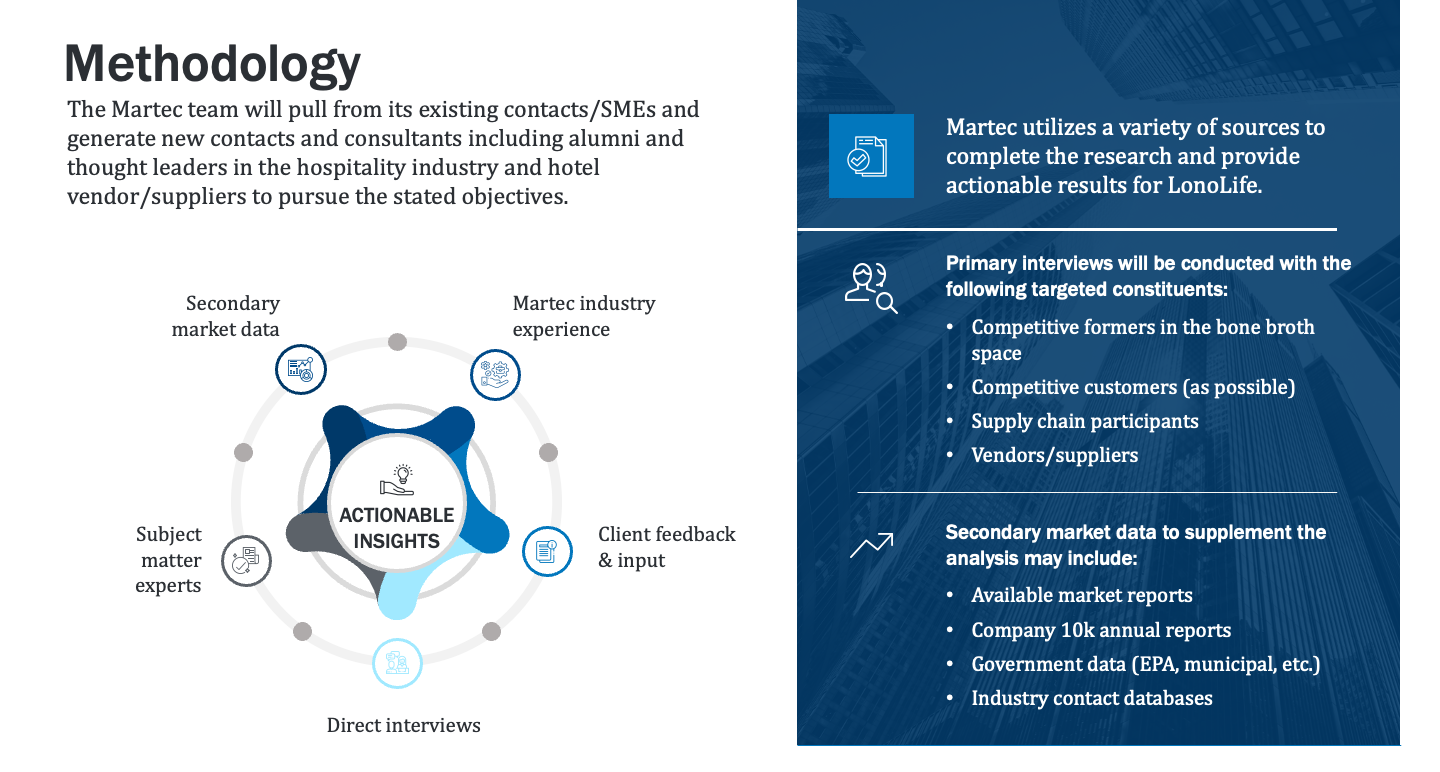

To build a full picture that becomes vetted and verified, we combine secondary research (industry reports, databases, public filings) with direct primary research—interviews with customers, competitors, suppliers, and other stakeholders. We tailor the mix to fit the needs of the engagement, using proven methodologies but customizing the scope, questions, and tactics based on what the investor needs to know.

One of the most important aspects of successful research is building relationships with industry experts across a wide range of industries. These relationships aren’t built overnight; they can take years of engagement and trust-building. Once rapport is established, experts become more than just sources of information — they become willing and invested collaborators. Through multiple research projects, we’ve found that experts are more willing to share their honest, candid insights once they feel they’re working with someone who respects their knowledge and expertise. This type of trust can’t be rushed, but it’s essential for getting the most detailed responses.

To foster this critical credibility and respect, it’s crucial to immerse oneself in the industry being studied. Facilitators need to understand the technical language, key trends, and the challenges research participants face in their day-to-day lives. One must make a concerted effort and demonstrable ability to “talk the talk” during interviews, which immediately signals to respondents that the researcher is not just an outsider collecting generic information. This kind of preparation is especially important in niche industries like private equity, where participants appreciate speaking with someone who can engage on a deeper level about their work.

Final Thoughts: Markets Matter—But So Do Customers and Competitors

We once heard a private equity partner say, “A deal lives or dies by the market.” And that’s largely true—but it’s only part of the story. A sound Commercial Due Diligence process balances market forces with a sharp understanding of the customer voice and the competitive field. That additional level of “triangulation” is where the real signal lies.

True, there is wisdom in markets; but it must never be forgotten that markets are made of customers…and both they and your competitors are keeping secrets from you. Intentionally or not. It’s your job—and our calling—to know as many of these “secrets” as possible in order to maximize upside and minimize risk.

Looking Ahead:

In the next installment, we’ll explore how to tailor Commercial Due Diligence to unique deal situations—and we’’ll share a customizable checklist we use to scope engagements across sectors and strategies.