China’s Green Commitment in a Global Context

China’s commitment to sustainability is paramount for the global climate transition. China is the world’s largest carbon dioxide gas emitter, accounting for roughly one-third of global emissions. As such, China has made “ecological civilization” a national strategy. President Xi Jinping’s vision of a “Beautiful China” comes with bold targets to peak carbon emissions by 2030 and achieve carbon neutrality by 2060. Many experts now believe China’s CO₂ emissions could peak by 2025, reflecting an accelerated green transition. Meeting these pledges is critical not only for sustainability in China but also for global climate efforts. For businesses and investors, China’s sustainability roadmap demands close attention, as it is reshaping industries and creating new opportunities in the world’s second-largest economy.

Optimising the energy mix

China still relies on coal for nearly 80% of its power, but the scale of its renewables build-out is unprecedented. By end-2024, wind and solar capacity topped 1.4 TW, exceeding coal capacity for the first time and supplying 22.5% of electricity in Q1 2025. In 2024 alone, China added 357 GW of new wind and solar—nearly twice the rest of the world combined. Companies in renewable equipment, grid modernization, and energy storage can tap a market that is investing over RMB 1 trillion annually in clean power and grid upgrades.

Sustainability starts with green transportation in China

After a decade of subsidies and incentives, China sold 12.9 million NEVs in 2024. This accounted for 41% of new-car sales, up from 31% in 2023. Domestic makers (BYD, Geely, NIO) now occupy 9 of the top 10 EV models, with Tesla as the sole foreign player. The transition to EVs creates demand for charging infrastructure, battery manufacturing, and recycling services. Foreign automakers without a strong NEV strategy risk losing market share.

Sustainable Fashion

The fashion sector is no longer overlooked in China’s green narrative. Designer Susan Fang pioneered an Air-Weave zero-waste process that layers fabric scraps, plant dyes, and embroidery so that every thread is used. Her signature glass-bead handbags reuse raw materials across multiple designs, minimizing inventory and landfill waste. Fast-fashion giants and luxury brands must adopt circular design or risk falling behind. Partnerships with eco-design studios and investment in made-to-order platforms can reduce inventory costs and appeal to eco-conscious consumers.

Source: Susan Fang’s official website, bead bags

Beauty and Consumer Goods

China’s beauty and personal care sector is also going green, led by brands like Yue Sai (羽西). Founded in China (now part of L’Oréal Group), Yue Sai built its reputation on blending traditional Chinese herbal ingredients with modern skincare. Today, the brand has overhauled its production to be more sustainable: instead of conventional chemical extraction methods (often wasteful and polluting). Yue Sai uses bio-fermentation and green chemistry to derive its botanical extracts. This biotech approach increases the yield and purity of active ingredients while sharply reducing chemical waste and energy usage in production. In other words, marrying modern science with TCM (traditional Chinese medicine) principles can achieve both efficacy and eco-friendliness in beauty products.

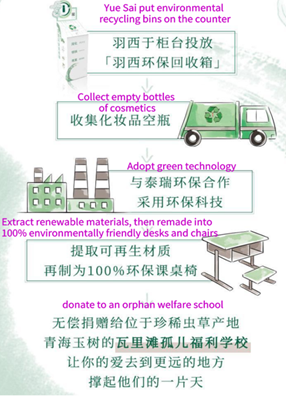

Yue Sai champions sustainability from packaging to post-use

Yue Sai extends sustainability to packaging and the post-consumer stage as well. The company introduced refillable packaging for many products (e.g., creams with replaceable inner cartridges), slashing single-use plastic in its high-end lines. In an industry where luxurious packaging often leads to excessive waste, this sets an important precedent. Moreover, Yue Sai launched an empty-bottle recycling program across China that gives used cosmetic containers a second life. The collected empties are processed and upcycled into desks and chairs for schools in underprivileged areas. This creative initiative, promoted via social media, not only reduces landfill waste. The proceeds support education for orphanage, earning kudos from eco-conscious consumers.

By embedding sustainability from product formulation through to disposal, China’s beauty industry is taking a holistic approach to “green” business. Brands like Yue Sai show that Chinese consumers will reward companies that prioritize safety, environmental responsibility, and social impact – all while delivering the quality they expect. Indeed, both multinational and local cosmetics brands in China are now following suit. Brands are exploring herbal formulations, cleaner production, and take-back recycling schemes as green beauty becomes mainstream.

Source: Yue Sai’s official Weibo account, empty bottle recycling process

ESG regulation

In May 2024, Shanghai, Shenzhen, and Beijing exchanges mandated comprehensive ESG reporting for large listed firms. Companies must disclose governance structures, carbon footprints (Scope 1–3), pollution metrics, and climate transition plans under a “double materiality” framework. Over 1,900 A-share firms published ESG reports in 2024. Strong ESG performance unlocks preferential loans, tax incentives, and better access to institutional capital. Firms failing to comply face reputational damage and potentially higher financing costs.

Waste management and circular economy

China targets 100% urban waste sorting by 2025 and recovery of 60% of construction and industrial solid waste. As of 2023, 297 cities cover 82.5% of communities with sorting programs; daily treatment capacity reached 530,000 tons. The 14th Five-Year Circular Economy Plan projects a 5 trillion recycling market by 2025. Waste-management companies, recyclers, and packaging innovators have a vast addressable market as municipalities and corporations upgrade facilities and adopt “resource recovery” models.

Sustainability in China: Navigating the green economy and ESG compliance

- China’s rapid expansion of wind and solar power, which outstripped coal capacity, creates vast opportunities for companies supplying clean-tech equipment, grid upgrades, and energy-storage solutions.

- With electric vehicles accounting for over 40 percent of new car sales in 2024, automakers and component suppliers must develop NEV-ready products and forge local partnerships to remain competitive.

- Leading fashion and beauty brands are embracing circular design and zero-waste processes to differentiate themselves; companies that fail to integrate resource-efficient models risk losing market share.

- New mandatory ESG reporting rules for listed firms establish sustainability disclosure as a core compliance requirement and offer preferential financing terms to high-performance companies.

- China’s trillion-yuan circular-economy push mandates waste sorting in all cities. Its ambitious recycling targets signal growing demand for recycling technologies. For instance, waste-to-energy services and sustainable packaging across both urban and rural markets.

Sustainability in China is no longer peripheral; it defines policy and consumer trends across sectors. Companies that integrate sustainable practices into their China strategies will unlock growth, mitigate regulatory risks, and strengthen their market position in an economy where green is the new competitive edge.