According to the 2024 China Gaming Industry Report, by 2024, China’s video game market’s actual sales revenue is projected to reach RMB 325.783 billion(USD 45.279 billion), a year-on-year increase of 7.53%, hitting a new high. The number of game users in China has reached 674 million, a year-on-year increase of 0.94%, also a historical peak. Among them, as a dark horse in domestic video games, ‘Black Myth: Wukong’ achieved annual sales of 28 million units, with a revenue of RMB 9 billion (USD 1.24 billion), and achieved extraordinary honors for China’s video game market internationally.

However, it should not be overlooked that beneath the ostensibly impressive achievements, the market faces significant concerns. The most pressing of which pertains to the regulatory measures aimed at preventing addiction among minors.

Government intervention: A double-edged sword

China’s video game market crackdown since 2019

To curb youth video game addiction, the Chinese government has implemented stringent regulations on the market since 2019. These include restrictions on in-game character design and strict limitations on the amount of time minors are allowed to play. In August 2021, Chinese authorities further tightened these rules. As such, minors can only access online games for one hour per day on Fridays, Saturdays, Sundays, and public holidays. However, other forms of online entertainment, such as short video platforms, remain unrestricted by these policies.

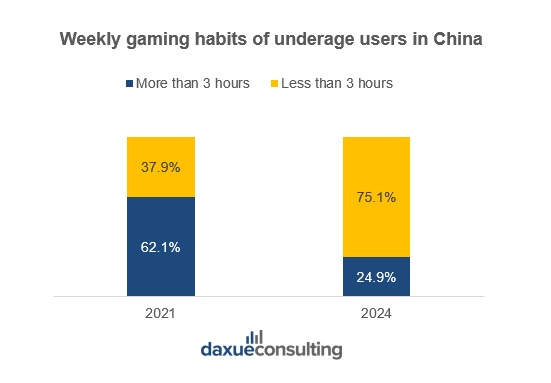

After being implemented for more than three years, this policy has achieved many results. According to the 2024 report on the state of anti-addiction measures for minors released by National Business Daily, the number of underage users in China’s video game market, along with their average play time and in-game spending, has declined across the board.

Gaps in parental supervision under China’s gaming restrictions

Of course, no policy can completely eliminate loopholes. According to a report by The Paper, more than 20% of underage gamers continue to access online games even after triggering anti-addiction prompts, often by using or renting the identity information of other adults. This workaround is largely facilitated by the minors’ guardians—their parents.

Over 80% of parents know about China’s “Minors Protection” policies. Moreover, 90% agree that anti-addiction technologies in games are useful. Yet, many still let their children bypass these systems. Up to 33.64% of surveyed parents admitted to registering game accounts for their children using their own ID cards to help circumvent anti-addiction restrictions.

Why do parents allow rule circumvention?

This seemingly contradictory behavior stems from the common practice among Chinese parents of using gaming as a form of reward, for example, allowing children to play video games after completing homework, achieving good academic results, or demonstrating good behavior. Another frequently cited reason is concern over the child’s personal data privacy.

These findings highlight a critical insight: parental attitudes play a decisive role in the actual effectiveness of China’s anti-addiction policy.

Chinese video game companies are facing regulatory pressure

Unlike underage users, who often have their parents as a buffer between them and regulatory systems, Chinese video game companies face regulatory pressure in a far more direct and uncompromising manner. Though Nation Press and Publication Administration approved more than 1,400 games in 2024, including 1,306 domestic games and 110 games from foreign publishers, setting a record high since 2019, domestic sales of locally developed video games are expected to grow by just 1.7% to RMB 261 billion (USD 35.6 billion) in 2024, forcing Chinese game studios to expand into overseas markets.

How Chinese game companies adapt to regulations

Major firms such as Tencent and NetEase have made significant adjustments to comply with government requirements. For example, Tencent raised the minimum age for in-game payments from 8 to 12 years old, while NetEase mandates facial recognition during account registration for users over the age of 70.

These increasingly stringent restrictions have made it difficult for companies in China’s video game market to generate meaningful revenue from their underage user base. Fortunately, forward-thinking Chinese companies have turned their attention to overseas markets—and with great success: in 2024, the actual sales revenue of Chinese-developed games in international markets reached USD 18.557 billion, marking a year-on-year increase of 13.39%.

Some underage restrictions imposed by China’s video game companies

| Tencent Games | MiHoYo | HYPERGRYPH | |

| Representative Title | Honor of Kings | Genshin Impact | Arknights |

| Real-name verification | Yes | Yes | Yes |

| Facial recognition | Yes, random timing | ||

| Minor account system | Yes | Yes | |

| No payment under 8 y/o | Yes | Yes | Yes |

| No payment under 12 y/o | Yes | Yes | |

| Secondary verification for payment | Yes | Yes | |

| Play time restrictions | Only Fri/Sat/Sun & holidays, 8-9 PM | Yes | Yes |

Data source: Public information, compiled by Daxue Consulting

Blending the digital and the physical: The ‘out-of-bound’ effect of games fuels the growth of local cultural tourism

Government support facilitates the rise of Chinese AAA title

Government intervention in the video game sector is not universally negative. In 2024, the domestically developed AAA title Black Myth: Wukong garnered widespread attention both within China and internationally. By the end of 2024, the game had sold over 28 million copies, generating RMB 9 billion(USD 1.24 billion) in revenue.

Local government support—particularly from Shanxi Province—played a pivotal role in the game’s development. In fact, the Shanxi Provincial Department of Culture and Tourism, along with the provincial cultural heritage department, have been collaborated with the game team for location shooting since the beginning stage of the game.

Beyond the screen: How China’s video game drives tourism boom

It is evident that the backing provided by the Shanxi provincial government was rewarded handsomely through the game’s commercial success. Following the release of Black Myth: Wukong, it quickly attracted a large number of visitors to the game’s main filming location—Shanxi—for on-site exploration. According to data from Meadin, interest in Shanxi tourism doubled on the day the game was released, compared to the previous month. Leading online travel platform Ctrip quickly launched five cultural heritage tour packages, including a 12-day tour of Shanxi and a 3-day itinerary in Datong. These tours featured iconic historical sites that appeared in the game, such as the Yungang Grottoes, Huayan Temple, Yingxian Wooden Pagoda, and the Hanging Temple.

“The viral success of Black Myth: Wukong has undeniably brought increased visibility to these scenic spots,” said Liu Xiaogang, director of the Xiaoxitian Scenic Area in Xi County. “On August 20, our site welcomed over 1,400 visitors, and on August 21, more than 1,500.”

The phenomenon of Black Myth: Wukong transforming online gaming popularity into offline tourism momentum has been highly praised by several official media outlets. This includes the Ministry of Culture and Tourism and Xinhua News Agency. This has prompted new reflections among Chinese game developers: if video games can contribute to real-world economic growth or the promotion of Chinese culture, they are more likely to gain favorable support from government authorities.

Government recognition promotes E-sports in China 2025

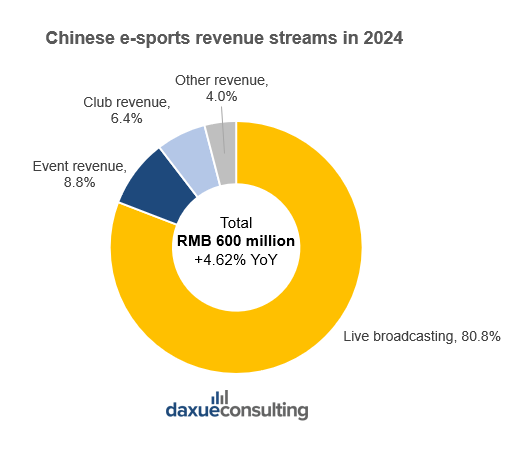

As an emerging industry, China’s e-sports industry is experiencing rapid growth. In 2024, the actual sales revenue of the Chinese e-sports industry reached 27.568 billion RMB, marking a year-on-year increase of 4.62%. Driven by a gaming population exceeding 600 million, China has firmly established itself as the world’s largest gaming market and a global e-sports hub. Clearly, the Chinese government has recognized the vital role that e-sports can play in boosting the real economy and enhancing cultural soft power.

How do e-sports benefit participants?

The prosperity of the e-sports industry is largely driven by the attention and vast audience generated by competitive gaming events—factors that constitute the primary sources of e-sports revenue. Professional players, along with their affiliated gaming clubs, video game companies, media outlets, sponsors, streaming platforms, and tournament organizers, all benefit from this ecosystem. In China, livestreaming contributes to over 80% of the industry’s total revenue. Many active and retired professional players operate livestreaming accounts and sign agreements with their clubs or gaming guilds to attract viewers by leveraging their popularity.

designed by Daxue Consulting, Chinese E-sports revenue streams in 2024

Official support fuels the growth of the e-sports industry

The significant attention and revenue generated by the e-sports industry have drawn the attention of the Chinese government. In 2024, China hosted a total of 124 non-exhibition e-sports tournaments at or above the provincial level featuring professional players.

Major e-sports events held in China in 2024

| Game | Place | Time | |

| Intel Extreme Maters Chengdu 2024 | Counter-Strike 2 | Chengdu | 2024.4 |

| 2024 League of Legends Mid-Season Invitational | League of Legends | Chengdu | 2024.5 |

| VALORANT Champions Tour 2024: Masters Shanghai | Valorant | Shanghai | 2024.5 |

| CS Major | Counter-Strike | Shanghai | 2024.12 |

Data source: Public information, compiled by Daxue Consulting

Notably, 58% of these events were held entirely offline, attracting large audiences and contributing to the industry’s rapid growth. Such achievements would not have been possible without strong policy support from both central and local governments. In 2024, a State Council bulletin officially categorized e-sports as a part of digital consumption, emphasizing the enhancement of its cultural value. Additionally, China incorporated creative digital industries—including e-sports—into its national strategic plan for emerging industries.

How can brands earn government favor in China’s e-sports industry?

As we discussed in the chapter on Black Myth: Wukong, the Chinese government places great importance on the role of China’s video game market in enhancing the country’s cultural influence and international image. This is seen as a key component in developing digital cultural trade and creating Chinese cultural symbols with global appeal. In fact, as early as 2019, the central government issued a development guideline for China’s video game market, aiming to use video games as international media to tell compelling Chinese stories.

In response to this policy, China’s esports industry has not only developed rapidly in recent years but has also begun exporting its model and influence abroad. For example, Honor of Kings—a game whose characters are largely based on Chinese mythology and historical figures—has held tournaments in cities like Istanbul, Riyadh, and Kuala Lumpur, attracting a growing number of international players. This has effectively promoted Chinese culture through gaming.

Therefore, if a brand can align esports with Chinese cultural elements, it will be more likely to receive support from the government.

China’s video game market: From local restrictions to overseas ventures

- In 2024, China’s video game market is projected to reach RMB 325.78 billion(USD 45.279 billion) in revenue, with over 674 million users—both figures setting new records.

- Despite high approval of anti-addiction measures, around 30% of surveyed parents admitted to helping their children bypass restrictions, limiting policy effectiveness.

- AAA games drive real-world impact. For instance, Black Myth: Wukong not only achieved global sales success but also boosted Shanxi’s tourism industry. This showcases the economic potential of digital-physical integration.

- E-sports is now part of China’s strategic plan for emerging digital industries. In 2024 alone, over 120 professional-level events were held, many offline.

- Games and brands that promote traditional Chinese culture and storytelling are more likely to receive policy backing and favorable media coverage.