In China’s evolving consumer market, a trend has taken hold: the strong emergence of the second-hand luxury market. Once considered shameful, it is now a symbol of savvy shopping. The global second-hand luxury goods market grew to an estimated USD 55 billion in 2024, and outpaced the sales of new luxury goods, with a 7% increase at the current exchange rate. Items like watches and jewelry make up the majority of these sales, accounting for up to 85% of the total. China’s second-hand luxury market is expected to grow to USD 30 billion (RMB 215 billion) in 2025 from USD 8 billion (RMB 57 billion) in 2020.

Download our China luxury market report

How China has emerged as a key market for second-hand luxury products

This trend is particularly pronounced in China, where the second-hand and grey market for luxury items is expanding. As luxury prices rise amid economic uncertainty, shoppers seek cheaper alternatives. For a long time, Chinese consumers were reluctant to buy used luxury products. Buying pre-owned items used to feel shameful to many people. In a culture that values “face” and social status, buying used goods was once seen as shameful.

Nowadays, Chinese consumers are increasingly embracing the purchase of second-hand luxury goods as a way to access premium products at more affordable prices. Factors such as environmental concerns, desire for unique products, and changing attitudes towards luxury consumption have also contributed to the rise of this segment. Millennials (29-41) dominate pre-owned luxury purchases, while Gen Z buyers are drawn to unique and limited-edition designs. Within this, female Gen Z buyers are the biggest demographic of second-hand shoppers, accounting for 65% of all sales in China.

Social media users and advocates argue that buying second-hand luxury is a sign of good taste. They argue that it allows one to find rare products with original designs that were discontinued years ago. However, often have better craftsmanship and quality than modern goods, because nowadays, luxury houses focus more on profit. For example, Chanel ceased using 24-karat gold plating post-2008 to cut costs. The resale market allows fashion enthusiasts to find and purchase these rare, high-quality vintage bags.

Rise of second-hand online platforms

Platforms such as ZZER and Dewu have revolutionized reselling, taking a commission on each sale. ZZER’s Shanghai store alone processes 5,000 daily listings, highlighting the sheer volume of luxury goods changing hands. On ZZER’s platforms, a Louis Vuitton bag was on sale for RMB 4,762 compared to its original price of RMB 14,300. Consumers who buy second-hand are either looking for deals or searching for high-end products that can preserve their value or even appreciate, as a form of investment. These second-hand platforms have also attracted many international customers who are on the hunt for bargains. Dewu’s luxury products are often sourced overseas and are sold at discounts of 20% to over 50% compared to the original price. Dewu’s Q2 2024 sales across 48 brands grew 19% YoY, exceeding RMB 7 billion.

Source: Xiaohongshu @676840712, ZZER’s physical store in Shanghai

What pushes consumers to buy second-hand in China

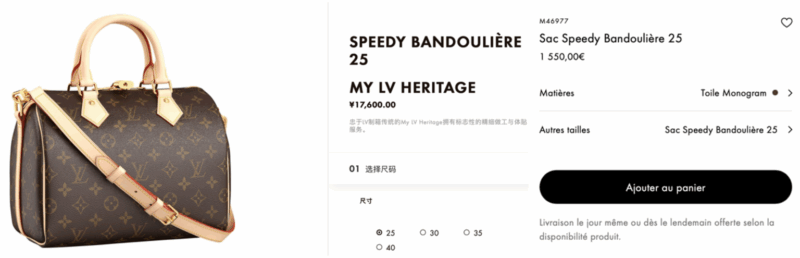

Second-hand consumption has also become extremely trendy among young shoppers, and buying pre-loved goods has become mainstream in China. Rising prices of luxury brands are one of the main reasons consumers are turning to the secondary market, along with high taxes on imported luxury goods. Strict regulations on import duties and consumption taxes also make luxury goods prohibitively expensive for many Chinese consumers. This also includes the government-imposed stricter border controls, which eliminate the possibilities of Daigou. The estimated price difference between Europe and China for new luxury items is 30% on average. For example, a Louis Vuitton Speedy 25 handbag in Europe would cost EUR 1,550 against RMB 17,600 (around EUR 2,260) in China, which is 31.4% more expensive. As a result, savvy shoppers who cannot go overseas to buy brand-new bags turn to the second-hand market to access luxury goods at more affordable prices.

Social media is a catalyst for second-hand success in China

With live streams and social media posts shared by young consumers, it has become easier for people to discover different styles and make purchases. In a country where 1.02 billion people use social media, platforms like Xiaohongshu and Douyin have become essential to the second-hand market in China.

Many stores decide to operate online, hosting livestreams on Douyin where they present their pre-loved handbag stock and showcase the price difference with brand-new products from the store. UIBE reported that for luxury product purchases, 53% of consumers purchase from domestic brick and mortar stores, while 42% of total transactions were made online, and 5% of consumers conducted the shopping overseas.

Luxury-focused influencers like Mr. Bags (包先生), 858.2k followers on Xiaohongshu, and Sun Shaqi (小小莎老师), 889.3k followers on Xiaohongshu, also help draw attention to second-hand products. Recently, in one of her livestreams, Sun Shaqi highlighted that “For the price of one single new bag, you can buy three or four pre-loved. It’s a good deal, isn’t it?”

Beyond influencer marketing, social media algorithms and hashtag culture have also directly impacted sales, with the hashtag #二手奢侈品 (second-hand luxury goods) on Xiahongshu accumulating over 4 million posts and 2.2 billion views as of August 2025. However, the sale of pre-loved luxury items still makes up less than 5% of China’s total luxury market. This is much lower than the markets in the US and Japan, where second-hand markets make up for 31% and 28% of luxury consumption. This gap can be attributed to the earlier maturation of these markets and the long-standing affluence of their populations. Chinese consumers began acquiring luxury goods in large numbers as early as the 1970s. This creates a larger pool of pre-owned items available for resale.

Consumers’ trust and concerns

In a country where counterfeit goods, unmet delivery promises, and poor after-sales services contribute to users’ mistrust of resale apps, the focus on authenticity cannot be overlooked. Although mainstream platforms offer professional authentication services, many consumers still report encountering counterfeits and goods that don’t match the description. According to the China Consumers Association, 42% of complaints received about second-hand luxury products in 2024 involved product authenticity issues.

Thus, some companies are trying to fight against the general idea that second-hand luxury items are synonymous with “scams”. For example, Dewu has a unique “authenticate first, ship later” process, providing official certificates, anti-counterfeiting sets, and unique digital IDs for verified products.

Another issue is the inconsistent pricing system, where prices for the same product vary significantly across different platforms, sometimes by more than 30%. This lacks transparency and creates confusion for consumers. China currently has very few specific laws and regulations for second-hand luxury goods transactions. Most of the stakeholders rely on general laws such as the Consumer Rights Protection Law and the E-Commerce Law, which struggle to address specific areas of the industry. These laws cover product authenticity and return rights. However, it lacks protocols for verification and condition grading, which are the key challenges for second-hand products.

Growth opportunities and challenges

Despite the challenges, the industry is actively trying to self-regulate and innovate. Leading second-hand luxury goods platforms have jointly issued the “Self-Discipline Convention for China’s Second-hand Luxury Goods Trading Platforms”, with unified authentication standards and price reference systems. One of the brands in this, called Zhishe, launched a blockchain-based luxury goods digital passport project, aiming to cover 80% of its products by the end of 2025. By setting industry-wide authentication and pricing standards, these initiatives are rebuilding consumer trust with transparency.

Chinese second-hand luxury market cheat sheet

- China’s second-hand luxury market emerges as a shift in consumer habits is happening, with China’s market expected to grow to USD 30 billion by 2025.

- Second-hand platforms have emerged as an easy way for consumers to buy and sell, with these online retailers expanding into physical stores.

- High taxes on new luxury goods in China, making them 30% more expensive than in Europe, drive consumers towards the second-hand market.

- With over 1 billion users on Chinese social media and two-thirds buying through livestreams, platforms like Douyin and influencers with millions of followers are propelling the second-hand luxury market.

- Challenges such as the lack of trust towards whether platforms are offering authentic products with quality after-sales services are raising concerns among the most skeptical customers.

The second-hand luxury market in China is experiencing significant growth, driven by sustainability trends, changing consumer attitudes, and economic factors. Daxue Consulting offers targeted consumer insights into this burgeoning market, helping businesses understand the unique motivations and behaviors of Chinese consumers in the luxury resale space. Our market research in China equips companies with the knowledge to adapt their strategies to meet evolving demands and capitalize on emerging opportunities. By leveraging our consulting services, you can gain a competitive edge in this dynamic market. Reach out to us to explore how we can assist your business in navigating the complexities of China’s second-hand luxury market.