When discussing digital transformation and innovation with clients in the banking and financial services (FS) sector, identity verification (IDV) often tops their agenda. A seamless digital onboarding experience is crucial, and it can determine whether a customer proceeds with or abandons a new banking relationship. There is also a growing need for more seamless, effective, and secure IDV in the FS industry due to the rise of sophisticated fraud tactics like deepfakes and increasingly complex regulatory requirements. My latest report, The State Of Identity Verification In The Financial Services Industry, highlights four key challenges that FS firms face:

- Deepfakes are challenging established IDV capabilities. The increase in AI-generated content means that deepfake-related cyberattacks are on the rise. Generative AI (genAI) face attacks, face-swapping, and synthetic faces will continue to be increasingly common; to combat these threats, we expect that IDV vendors will increase their investments in genAI-based deepfake detection technologies like generative adversarial networks and multimodal sense algorithms.

- Outdated onboarding experiences are stalling business growth. Customers demand fast and reliable onboarding processes, but traditional IDV methods create friction and false positives, deterring legitimate customers and reducing conversion rates. FS firms need to offer integrated identity experiences during onboarding and beyond to address ongoing authentication throughout customer journeys.

- Regulatory compliance is increasingly complex and costly. Evolving regulations – such as regional mandates, privacy laws, know-your-customer, and anti-money laundering regulations – are adding compliance pressure. Firms need flexible and scalable IDV solutions to navigate these complexities.

- Managing IDV costs is becoming crucial. As competition for new customers intensifies, FS firms strive to enhance UX and lower the cost of acquiring customers. For example, pay-per-IDV-check allows FS firms to reduce cost at scale. Multilayered verification systems also help FS firms to avoid costly and time-consuming checks, thus providing improved UX.

Involve Multiple Roles And Stakeholders When Adopting IDV Solutions

Beyond its role in fraud prevention, IDV solutions build customer trust and support business growth. A multistakeholder approach is crucial for adopting these solutions because it ensures comprehensive risk management, enhances customer experience, and meets regulatory standards. Fraud and risk management teams focus on protecting against sophisticated threats like identity theft and account takeover fraud; customer experience teams ensure that IDV processes do not hinder smooth onboarding, balancing security with usability; and compliance officers stay updated on regulatory changes and ensure adherence to requirements, preventing financial crimes like money laundering. By involving these key stakeholders, FS firms can adopt robust, user-friendly, and compliant IDV solutions, leading to better business outcomes.

Improve The Effectiveness Of Each IDV Lifecycle Stage With Key IDV Technologies

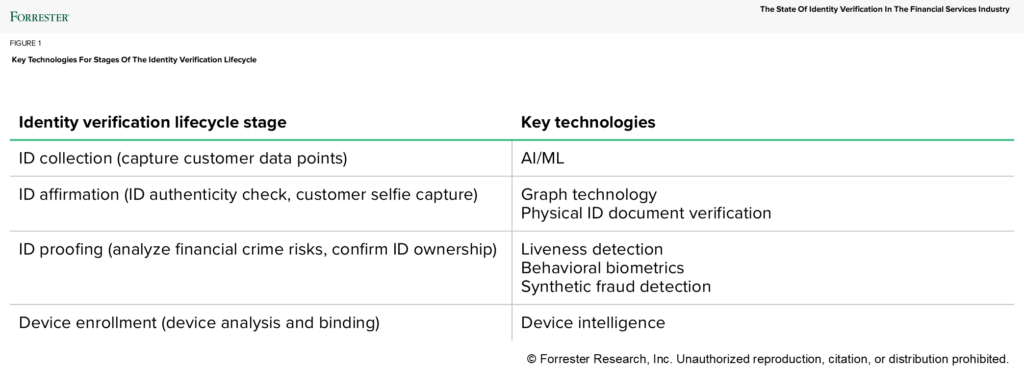

IDV solutions are evolving rapidly, and FS firms should implement dynamic IDV strategies to optimize verification paths, reduce friction, and enhance UX. My report features a useful graphic that maps out key IDV technologies that firms should leverage at each IDV lifecycle stage to improve its experience and effectiveness.

FS firms are increasingly challenged on many fronts, and they must move away from manual and legacy IDV processes which hinder growth, create operational inefficiencies, and increase fraud risk. FS firms must adopt modern IDV solutions to stay competitive, ensure regulatory compliance, and provide a superior customer experience.

Read our full report, The State Of Identity Verification In Financial Services, to explore these insights, enhance your IDV processes, improve customer experiences, ensure regulatory compliance, and achieve better business outcomes. Forrester clients can schedule a guidance session or inquiry with me for further discussion.