On May 28th, 2025, e.l.f. Cosmetics acquired Rhode, the minimalist skincare brand founded by Hailey Bieber, for a reported USD 1 billion. While the acquisition signals Rhode’s strong performance in the U.S., its presence, or more accurately, absence, in China is an equally fascinating story. Despite no official launch, Rhode has quietly become a cult favorite among Chinese beauty consumers. On RedNote (also known as Xiaohongshu in China) the hashtag #Rhode garners 70.5m views and 130.1k notes. On Taobao and other e-commerce platforms, the brand’s peptide lip treatment is widely available via 代购 (daigou, gray-market resellers), while further proof of demand is that counterfeits of Rhode in China are common.

How Rhode wins China without a market entry

Virality beats geography in today’s beauty game

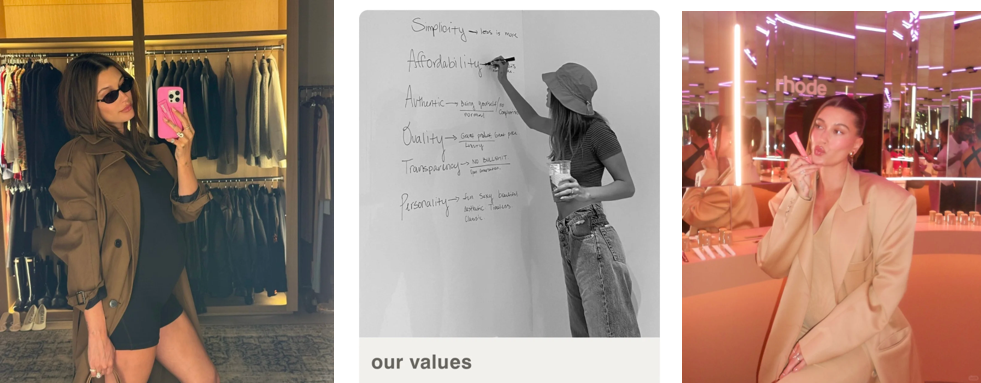

Rhode is riding China’s “白女美学 white girl aesthetics” beauty wave, viral aesthetics that championed minimalism, glow, and a curated sense of effortlessness. These trends, inspired by the West, were quickly adopted and remixed on Chinese platforms like Xiaohongshu and Douyin.

At the center of this movement was Hailey Bieber, whose personal style, glassy skin, slick-back hair, off-duty model outfits, came to represent the “global cool girl” look. For many Gen Z women in China, it wasn’t just about skincare, but about accessing a lifestyle: understated luxury, quiet confidence, and global cultural fluency.

What made Rhode stand out was its perfect alignment with this aesthetic. The brand became a visual extension of Hailey’s persona, helping Chinese fans feel like they, too, could achieve this aspirational vibe, just a peptide lip treatment away.

Skincare with substance speaks louder than celebrity

Simplicity

Young Chinese consumers are no longer swayed by celebrity endorsements alone. They’re looking for brands that align with their evolving values around beauty, identity, and consumption. Rhode resonates because it embodies a clear, modern ethos that speaks directly to this audience. Its product line is purposefully minimalist, with fewer than 10 SKUs, aligning perfectly with the “精简护肤 streamlined skincare” trend gaining momentum in China. This shift reflects growing skepticism toward overly complicated routines and a preference for efficiency, skin health, and ease of use.

Affordability & transparency

Rhode’s pricing strategy also hits the mark—it delivers high perceived quality at an accessible price point. In an environment where “value for money” is more than just a budgeting concern but a lifestyle mindset, especially amid economic uncertainty, this combination of affordability and quality appeals deeply to Chinese consumers.

Authenticity & personality

Just as importantly, Rhode’s brand personality feels real. Hailey Bieber’s personal involvement, including her routines, product walkthroughs, and visible hands-on approach, lends a layer of authenticity that many celebrity brands lack. Instead of feeling like a cash-grab extension of her fame, Rhode is positioned as an extension of her values and aesthetic. This transparency and relatability are key in a market where young consumers demand not just good products, but brands that “get” them.

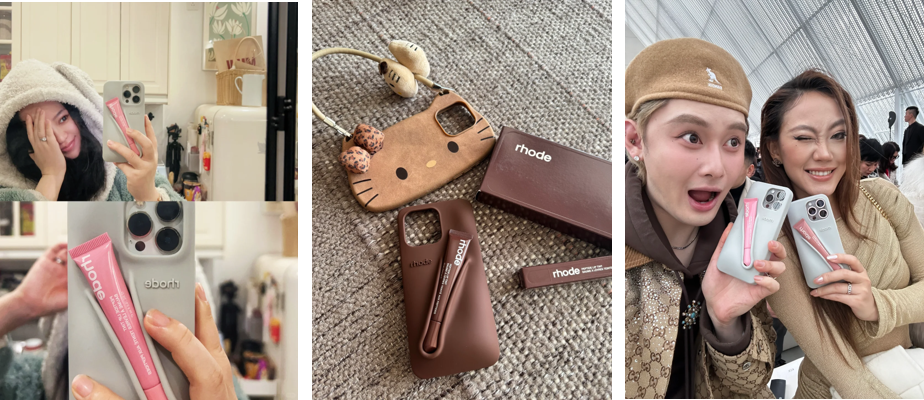

Performance-led yet aesthetic-driven products

For Chinese beauty consumers, especially the digitally native Gen Z, a product’s appeal goes far beyond the ingredient list. Efficacy is essential, but aesthetic design and social virality are just as important. Rhode succeeds by delivering on both fronts. Its formulas center on proven, skin-repairing ingredients like peptides, niacinamide, and barrier-focused actives. But what truly sets Rhode apart is how visually desirable the brand is. The glossy, pastel-toned packaging, and even the way the products look in a “shelfie” make them inherently shareable.

One of the most viral examples? Rhode’s phone case lip gloss holder, a functional yet playful design that turned a product into a statement accessory. It wasn’t just a beauty product but a lifestyle flex, sparking content trends across Chinese platforms.

The flip side: Rhode in China is facing challenges

A slim product portfolio with hero-product risk

While Rhode’s aesthetic and values clearly resonate with Chinese Gen Z, its next chapter raises deeper strategic questions. Despite the growing buzz on social media, the brand has yet to officially enter the Chinese market. Is this a missed opportunity, or a smart delay?

From a product standpoint, Rhode still feels early-stage. Its product line is intentionally minimal, but that also means it relies heavily on a few hero SKUs, like the peptide lip treatment. This lack of category breadth may limit its long-term growth or leave it vulnerable if a single product trend shifts.

Daigou’s impact on brand consistency

Without official presence, Rhode’s image is currently shaped by daigou and an increasing wave of counterfeit or unverified products on Chinese e-commerce platforms.

On Taobao, prices for the peptide lip treatment (officially priced at USD 18) range wildly, from as low as RMB 10 (USD 1) to over RMB 200 (USD 27), with some unofficial stores selling products at RMB 30 (USD 4) and racking up over 20,000 units sold. These unregulated sales not only complicate pricing and inventory control, but also blur product authenticity, distort brand positioning, and risk undermining consumer trust, especially in a market where quality and credibility are paramount.

Beyond Hailey: The need for independent brand storytelling

More critically, Rhode is still in the process of building a compelling brand narrative beyond Hailey Bieber herself. The brand’s identity is tightly interwoven with her lifestyle and image, which has served it well on platforms like TikTok and Instagram. But as one Chinese beauty investor put it: “In the celebrity beauty space, brands that fail to develop independent storytelling beyond the founder often hit a wall, especially when that celebrity’s influence fades.”

This is especially important in China, where celebrity fatigue is high, and where consumers are increasingly skeptical of “buzz-driven” brands. Investors and local partners may prefer a minority stake model, keeping Hailey involved for her creative influence and brand ethos, while ensuring a smoother transition should she ever step back from the spotlight.

In other words, for Rhode to thrive in China, it must both retain the emotional spark of Hailey’s IP and build hard-core operational strength, from R&D and local product-market fit to influencer networks and offline retail partnerships.

Takeaways: What Rhode in China can teach us about celebrity beauty brands global expansion

1. Aesthetic + Authenticity = Aspirational Power: Without an official China launch, a brand with the right look, values, and emotional tone can build buzz. Its “clean girl” aesthetic, minimalist routine, and Hailey Bieber’s relatable persona align closely with what Chinese Gen Z wants—beauty that feels both aspirational and authentic.

2. Social capital is not a substitute for market infrastructure: Despite its popularity, Rhode’s reliance on a few hero products and online-only channels poses challenges for sustainable growth. As beauty consumers in China grow more discerning, performance, innovation, and local presence become non-negotiable.

3. From celebrity brand to brand with a soul: Rhode must eventually evolve from a Hailey-centric brand to one with a standalone story. Chinese consumers are increasingly wary of “empty” celebrity brands. Future success depends on building enduring brand equity that resonates beyond the founder’s fame.

4. China requires both speed and substance: Rhode’s delayed market entry may help it refine its backend strength, but it also risks losing momentum. In China’s fast-moving beauty landscape, timing is critical. A brand that waits too long could find that trends, or consumer tastes, have already shifted.

The story of Rhode in China is still being written. On one hand, its massive organic traction hints at untapped potential, proving that a strong brand can cross borders through image and storytelling alone. On the other hand, meaningful growth in China demands more than good branding. It requires operational depth, local partnerships, and a long-term narrative strategy that goes beyond a single founder.

So, has Rhode missed its moment? Not necessarily. But its next move must be intentional. Whether through a soft-launch, localized content strategy, or future partnership with a local investor, Rhode will need to translate its cultural capital into business reality. Because in China, brand love may begin on Xiaohongshu, but it’s solidified through substance.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.