According to the 2021 China Dairy Index, most adults in China — roughly one billion people — are lactose intolerant. This high prevalence is largely due to the genetic factors common among Asian populations. However, this doesn’t mean Chinese people don’t consume dairy products at all. In fact, they do but just in smaller amounts or they turn to dairy products with lower lactose like cheese. In 2024, the cheese market in China reached RMB 87.4 billion, a year-on-year increase of 7%. However, overall Chinese cheese consumption is still very low, with an average of 250 grams per capita in 2023 — about what an Italian would consume in four days. As Chinese consumers become more open to Western dishes and incorporate cheese into their desserts and meals, the cheese market is projected to continue growing, reaching RMB 153 billion by 2032.

Download our China F&B White Paper

Young people in urban cities driving China’s cheese market

Health is a key factor driving people to consume cheese, as it is rich in protein, calcium, and vitamins and contains less lactose than milk. This makes it easier to digest and helps people meet their daily nutritional needs. Among younger generations and millennials, especially parents, an increasing number are becoming more aware of the health benefits of cheese. However, older generations and people in lower-tier cities are often unaware of these benefits and need to be educated about them.

Moreover, the growing middle class and increasing openness towards Western food are encouraging Chinese people to try different cheese-based dishes. In 2022, cheese penetration in first-tier cities was significantly higher than in other regions, reaching over 33.5%, a 10.5% increase from 2020. People in higher tier cities have access to more Western dishes like hamburgers. However, cheese consumption in lower-tier cities is expected to grow as China’s local-fast food industry rapidly expands and economic development continues.

How Chinese people are “inventing” new ways of consuming cheese

To encourage cheese consumption, many companies in China launch collaborations with foreign brands. For example, in 2024, the popular coffee shop and main rival of Starbucks in China, Luckin Coffee, launched a “Tom and Jerry” product collection, selling items like cups and merchandise. It also sold the brand new “New Zealand Cheese Latte”, a coffee with sweet cheese instead of the classic whipped cream.

Many Chinese people encountered cheese through the cartoon, so collaborating with the cartoon sparks curiosity among those who have not tried cheese and offers a more approachable way for those who don’t enjoy eating cheese on its own. This helped drive its success, with the official hashtag of the campaign #瑞幸联名猫和老鼠# (Luckin Coffee meets Tom and Jerry) having over 2.5 million views on Weibo as of April 2025.

Cheese sticks (奶酪棒) are another popular format, especially among children. Thanks to their high calcium content and lower lactose levels compared to whole milk, parents are incorporating them into their children’s diets. Moreover, their improved flavor – sometimes enhanced with sugar and fat- and their chewy texture make them more appealing. Social media platforms in China like RedNote (or Xiaohongshu in Chin) are buzzing with DIY videos on how to make them, with many surpassing 200,000 views as of April 2025.

Following the Italian “dolce vita” with cheese desserts trending on social media

Recent trends on RedNote highlight the growing popularity of incorporating cheese into desserts. For example, two famous desserts are panna cotta and tiramisu, two classic Italian desserts whose core ingredient is cheese. Panna cotta is typically served plain, allowing people to customize it with their own toppings. While tiramisu follows a specific recipe involving coffee-dipped biscuits and cocoa, users on Xiaohongshu are adapting it to Chinese flavors. By creating tiramisu with mango or melon jelly on top and other varieties, cheese is gradually becoming integrated into their daily diets. As of April 2025, videos under the hashtag #提拉米苏# (tiramisu) have garnered more than 2.2 billion views.

China’s heavy reliance on cheese imports — but for how long?

Overall, domestic dairy production in China can’t keep up with demand. In 2023, it amounted to 30.5 million tons, a slight year-over-year decline of 2% due to the post-COVID economic slowdown and a consequent imbalance between the low supply and high demand of raw milk. This supply-demand gap is evident in the cheese sector. In 2023, cheese demand reached 332,000 tons, while domestic production was far lower, at 172,000 tons. This has forced China to rely on cheese imports, with cheese imports accounting for 155,000 tons in 2024, a slight decrease from the previous year, when the imported volume was 162,000 tons.

This reliance on imports highlights that the cheese market still needs to be further developed. While China still relies on cheese imports, this could change with the growth of local brands. Local brands often have a better understanding of local tastes — for instance, some consumers avoid cheese because of its strong, sour, and salty taste — and adapt their products accordingly. This requires brands to understand the local market, leverage their strengths, and localize their products – as higher quality alone doesn’t guarantee success.

Domestic players gradually focusing more on cheese

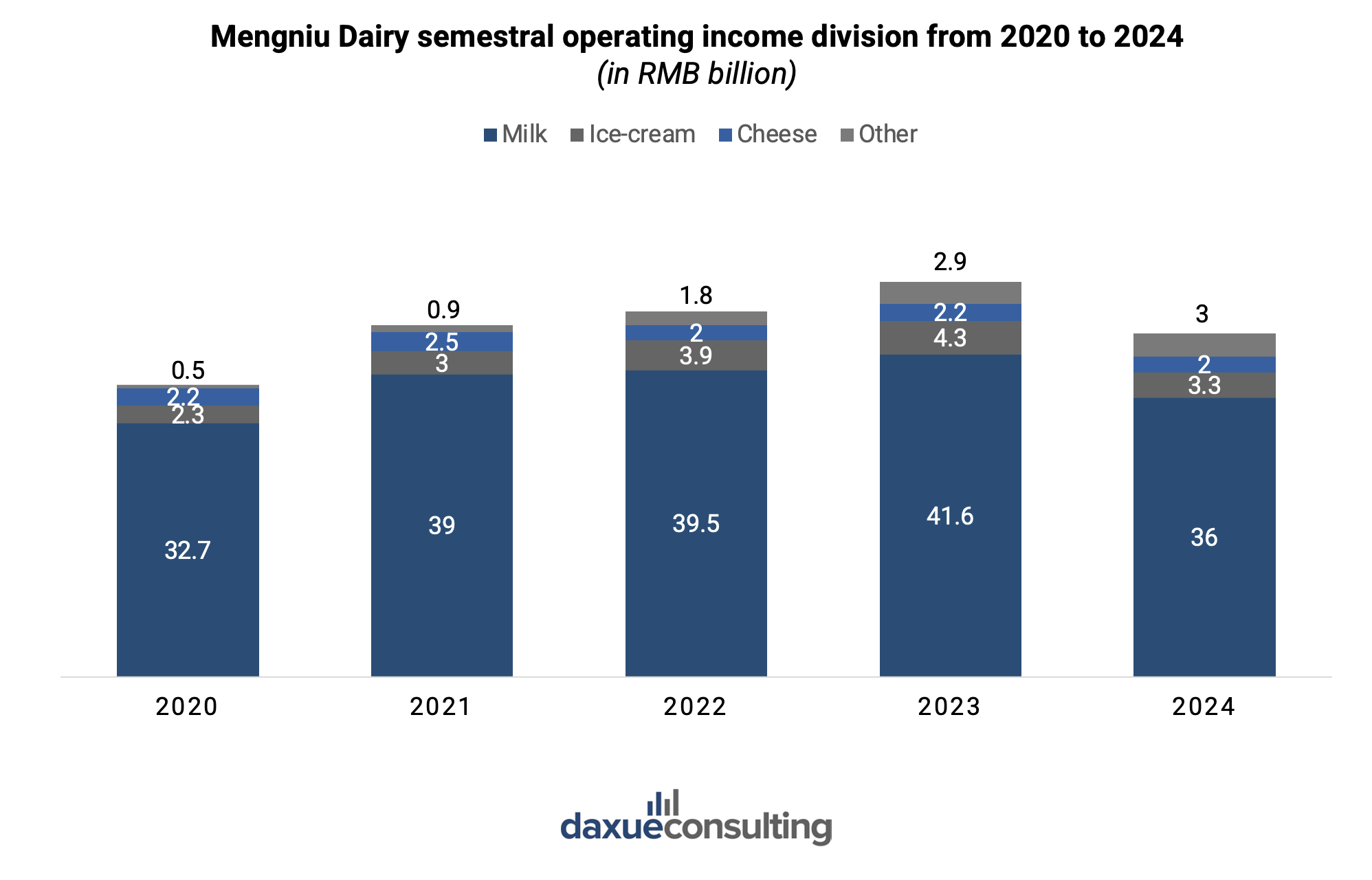

Mengu Dairy (蒙牛) is one of the biggest dairy and cheese producers in the country. In 2023, the company registered an operating revenue of roughly RMB 100 billion, with a year-on-year increase of 6.5%. Despite being one of the most important companies in the cheese market in China, revenue from cheese production is still low compared to other products to which the company chose to invest more in, such as ice cream and yogurt. In their report for the first semester of 2024, liquid milk held the highest production revenue, accounting for RMB 36.2 billion, whereas cheese placed third place with only RMB 2.1 billion.

Another giant in the cheese industry in China is Yili Industrial Group (伊利). In 2024, the company boasted RMB 7 billion in net income, reflecting a year-on-year increase of 19.4%. While Yili focuses on dairy products such as milk and yogurt, since September 2024, the company has been increasing its cheese production annually. One product growing in popularity is Yili’s cheese sticks, which appeal to parents for their children due to their high calcium content. These cheese sticks are easy to access as a casual snack and convenient for children to enjoy on the go.

New Zealand holds the largest import volume, but Italy is catching up

One of the top sources of cheese imports in China is New Zealand. It accounted for 60% of the total imports in 2024, followed by Australia (14%) and Italy (6.7%). Anchor was China’s top foreign cheese exporter, with a revenue of roughly RMB 8 billion in mid-2024 and China representing over 16% of their total worldwide sales volume.

Moreover, Italy is increasing its exports to the country. In particular, the premium products among Italian cheeses — Grana Padano and Parmigiano Reggiano — are rapidly gaining popularity in China, with their export volume rising to 121,000 tons in 2024, an 8.6% year-over-year increase. This growth reflects some level of awareness and interest in higher quality cheese. Likely due to their long maturation period (usually between 18 and 30 months), these cheeses are much appreciated in China, as they contain neither gluten nor lactose.

The government raising the bar on cheese standards

The Chinese cheese industry is expected to set higher standards for cheese and thus offer better and safer products to local consumers.

In 2022, the SAMR and the National Health Commission of the People’s Republic of China (NHC) set new national standards for the cheese industry to promote the standardized development and competitiveness of cheese products nationwide. Meanwhile, the Dairy Association of China (DAC) launched a “Three-Year Action Plan for Cheese Innovation and Development to Enhance Dairy Industry Competitiveness (2023-2025),” aimed at increasing production and sales of cheese by respecting higher safety requirements. According to this plan, the domestic cheese production is projected to reach 500,000 tons at the end of 2025.

As a result, in December 2022, the government enforced the “National Food Safety Standard for Processed Cheese and Cheese”, a set of regulations aimed at standardizing cheese production and ensuring compliance with safety and health standards. These efforts also extend to imports. In 2020, Europe and China signed an agreement to import geographically certified cheeses, with the regulations for this agreement coming into effect in 2021.

Key takeaways on small yet promising cheese market in China:

- Despite a high percentage of people being lactose intolerant, China’s cheese market has been steadily growing, as younger generations becoming more aware of the benefits of cheese and incorporate it into their meals.

- In recent years, many brands have collaborated to promote cheese consumption in China, such as Luckin Coffee with its New Zealand Cheese Latte. This has allowed people to have greater access to cheese, as it remains unapproachable for many on its own.

- Social media platforms have also played a key role in reaching younger audiences and inspiring the reinvention of cheese-based desserts such as tiramisu and panna cotta.

- Despite the demand for cheese, domestic production is very low. This makes the country rely on imports and shows there is significant room for development in the industry.

- Mengniu Dairy and Yili industrial group are two local players in the Chinese cheese market. Although their cheese production represents only a fraction of their total output, they appeal to local consumers with cheese products tailored to Chinese tastes.

- Although New Zealand is by far the biggest exporter of cheese to China, other countries are also on the rise. One of them is Italy, whose premium Italian Parmigiano Reggiano and Grana Padano, are increasing in popularity and export volume. This reflects growing awareness and demand for higher-quality cheese.